U.S. Raises Tariffs to 125% on China Imports: What It Means for Global Trade

On April 9, 2025, U.S. President Donald Trump announced an immediate increase in tariffs on Chinese imports, raising the rate from 104% to 125%. This decision is part of the administration’s broader strategy to address trade imbalances and respond to China’s recent tariff escalations.

Background and China’s Response

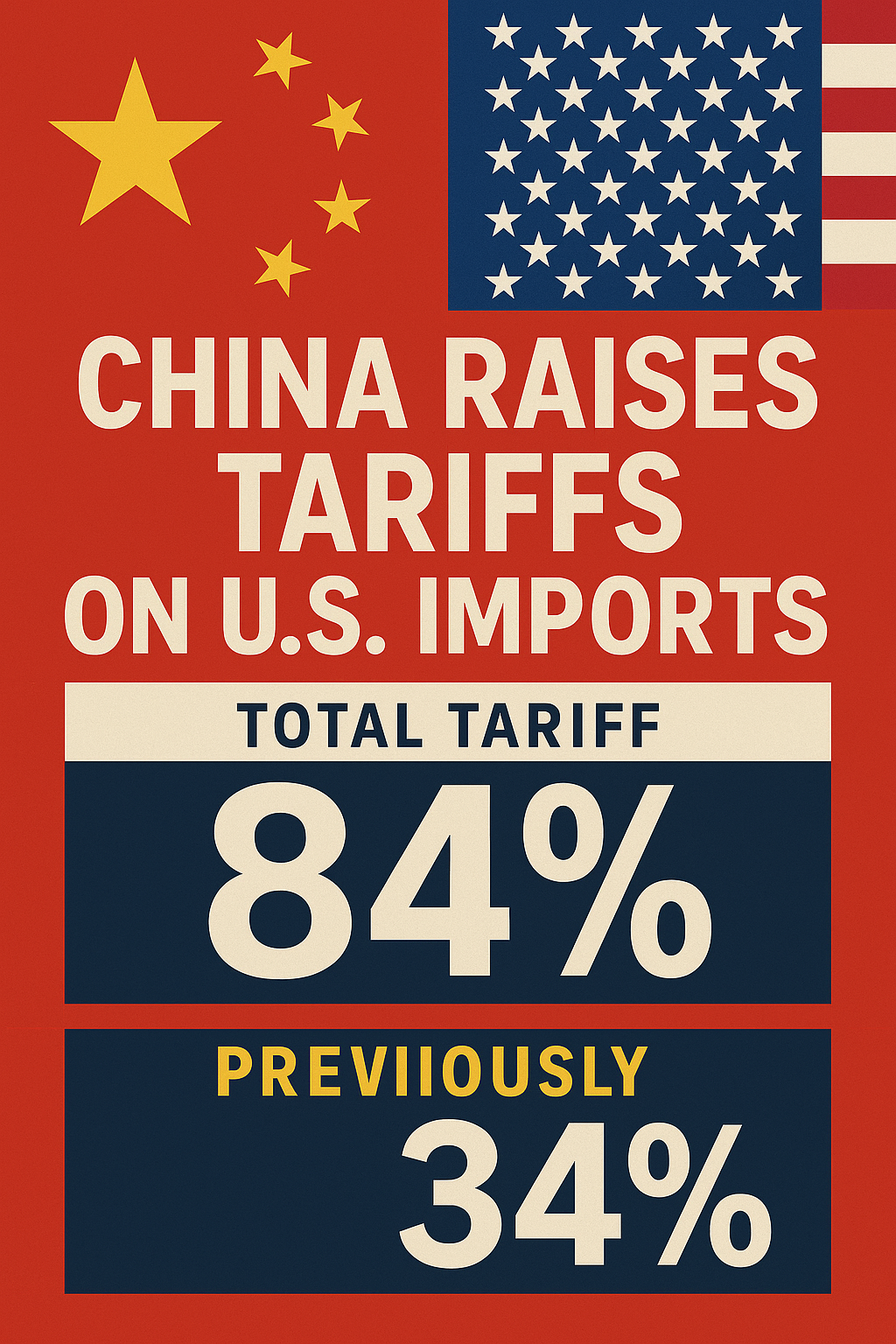

Prior to this U.S. action, China had imposed an 84% tariff on American goods, a significant increase from the previous 34% rate. This move by China was perceived as a retaliatory measure in the ongoing trade dispute between the two nations.

Impact on Businesses and Markets

The tariff hike has had immediate repercussions on businesses and financial markets:

- Chinese E-commerce Sellers: Many Chinese companies selling products on platforms like Amazon are contemplating raising prices for U.S. consumers or exiting the U.S. market altogether. The increased tariffs have disrupted cost structures, making it challenging for these businesses to remain viable.

- Global Financial Markets: The announcement led to significant volatility in global markets. However, following a 90-day pause on certain tariffs for other countries, markets experienced a surge. Asian markets, in particular, saw notable gains, with Chinese stock markets benefiting from state-backed buying.

International Reactions

The escalation has prompted varied international responses:

- European Union and Other Nations: While the U.S. has paused tariff increases for 90 days for several trading partners, including the EU, Japan, and South Korea, these nations remain cautious and are closely monitoring the situation.

- China’s Position: The Chinese government has expressed strong opposition to the U.S. tariff increases, indicating potential countermeasures and emphasizing the detrimental impact on global trade.

Economic Implications

Analysts are concerned about the broader economic implications:

- U.S. Economy: The increased tariffs may lead to higher consumer prices and potential job losses in industries reliant on Chinese imports. Businesses are facing uncertainty, leading to delayed investments and hiring decisions.

- Global Trade: The escalation in tariffs between the U.S. and China contributes to global economic uncertainty, with potential ripple effects on supply chains and international trade agreements.

Conclusion

The U.S.’s decision to increase tariffs on Chinese imports to 125% marks a significant escalation in the ongoing trade dispute. The move has prompted immediate reactions from businesses, financial markets, and international partners. The coming weeks are critical as both nations navigate the complexities of this trade conflict and its broader economic implications.