Can GravityX Exchange Help Diversify an Investment Portfolio?

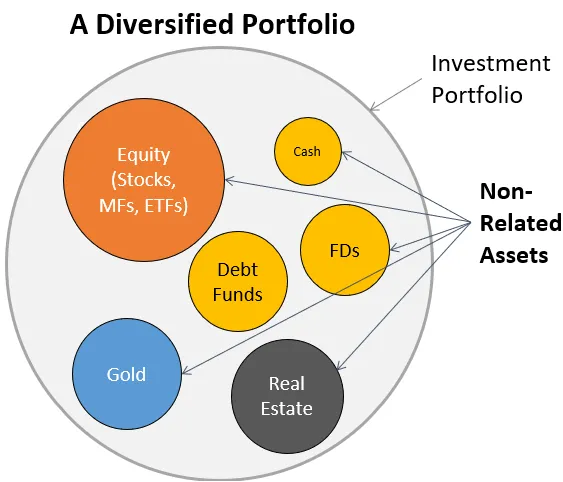

Diversification is a key strategy for investors seeking to manage risk while maximizing potential returns. It involves spreading investments across various asset classes, sectors, or geographical regions to reduce the impact of a single underperforming investment. With the rapid growth of the cryptocurrency market, many investors are looking at exchanges like GravityX Exchange to diversify their portfolios. In this article, we will explore how GravityX Exchange can play a role in portfolio diversification and the factors that can help investors make informed decisions.

Understanding GravityX Exchange

GravityX Exchange is a digital asset exchange platform that offers users the ability to trade cryptocurrencies, tokens, and other blockchain-based assets. With a focus on security, efficiency, and user experience, GravityX aims to provide a platform for both novice and experienced traders to interact with the growing world of digital currencies.

Some of the notable features of GravityX Exchange include:

- Wide Variety of Cryptocurrencies: GravityX offers access to a broad range of cryptocurrencies, from established coins like Bitcoin (BTC) and Ethereum (ETH) to newer altcoins and tokens. This wide selection provides opportunities for investors to diversify their holdings within the crypto market.

- Staking and Yield Generation: The exchange also provides staking services, which allow users to earn rewards by holding specific cryptocurrencies. This feature can help investors diversify by adding a passive income stream to their portfolios.

- Decentralized Finance (DeFi) Integration: GravityX integrates DeFi applications, enabling users to access decentralized lending, borrowing, and yield farming opportunities, all of which can enhance diversification by tapping into various aspects of the decentralized financial ecosystem.

- Security and Safety Features: GravityX employs industry-leading security measures to ensure the protection of users’ funds, which is crucial for those looking to invest across various assets without worrying about exchange risks.

How GravityX Exchange Helps in Diversifying an Investment Portfolio

- Access to Various Cryptocurrencies and Tokens One of the primary benefits of using GravityX Exchange is its wide range of cryptocurrencies and tokens. By providing access to both established and emerging digital assets, GravityX enables investors to allocate their portfolios across different sectors of the crypto market. For example:

- Large-cap cryptocurrencies like Bitcoin and Ethereum offer stability but slower growth potential.

- Mid-cap and small-cap altcoins can offer higher growth potential, though they come with increased risk.

- Tokens related to decentralized finance (DeFi) and blockchain projects can provide exposure to innovative sectors within the crypto space.

- Staking for Passive Income Staking allows users to lock up certain cryptocurrencies in exchange for rewards, such as staking rewards or interest. GravityX’s staking services provide investors with the opportunity to earn passive income while holding cryptocurrencies for the long term. This can add an income-generating component to an investor’s portfolio without needing to sell assets. By staking assets in GravityX Exchange, investors can:

- Earn rewards in the form of additional tokens.

- Diversify their portfolio by staking multiple coins and tokens.

- Take advantage of different staking opportunities with varying reward rates and risk profiles.

- Access to Decentralized Finance (DeFi) Products DeFi has emerged as one of the most innovative sectors within the cryptocurrency market, and GravityX Exchange provides access to decentralized financial products. By interacting with DeFi platforms, users can:

- Lend and borrow digital assets, providing access to new forms of liquidity.

- Participate in yield farming and liquidity mining, allowing users to earn rewards by providing liquidity to decentralized exchanges.

- Portfolio Flexibility and Risk Management Traditional investment portfolios often rely on a mix of stocks, bonds, and real estate. However, cryptocurrencies and blockchain-based assets can provide an alternative investment class that is not correlated with traditional markets. By incorporating digital assets into their portfolios, investors can protect themselves from market volatility or downturns in traditional sectors. With the broad selection of assets available on GravityX Exchange, investors can:

- Add digital assets that behave differently than stocks or bonds.

- Manage risk through diversification by choosing assets that are less correlated with traditional markets.

- Take advantage of unique asset classes like DeFi tokens, NFTs, and other blockchain-based innovations.

- Liquidity and Trading Opportunities GravityX Exchange offers high liquidity across various assets, ensuring that investors can quickly enter and exit positions as needed. This liquidity is crucial for managing risk, as investors can make adjustments to their portfolios in real-time based on market conditions. Additionally, GravityX’s trading platform provides a range of tools, including charting and technical analysis, which can help investors make informed decisions when it comes to timing their trades. These tools allow users to diversify their strategies based on both technical indicators and market sentiment.

Risk Considerations for Diversification on GravityX Exchange

While GravityX Exchange offers many opportunities for diversification, there are risks associated with investing in cryptocurrencies, and these risks should be carefully considered:

- Volatility: The cryptocurrency market is notoriously volatile, and the value of assets can fluctuate significantly in a short period. This can lead to both potential rewards and substantial losses.

- Regulatory Risk: Cryptocurrencies are still in a gray area in terms of regulation in many countries. Investors should consider the regulatory landscape in their region and be aware of any potential changes in laws that could affect their holdings.

- Security Risks: While GravityX Exchange employs strong security measures, no platform is entirely immune to risks like hacks or cyberattacks. It’s essential for investors to implement their own security practices, such as enabling two-factor authentication and using cold wallets for long-term holdings.

- Liquidity Risk: Some smaller altcoins or tokens may have lower liquidity, making it harder to enter or exit positions without significant price fluctuations. Investors should be mindful of the liquidity of the assets they are investing in.

Conclusion

GravityX Exchange offers a variety of tools and features that can help investors diversify their portfolios. With access to a wide range of cryptocurrencies, staking opportunities, and decentralized finance (DeFi) services, GravityX provides a comprehensive platform for building a well-rounded crypto investment strategy.

However, as with any investment, it’s essential to conduct thorough research, understand the risks involved, and make informed decisions. By using GravityX Exchange wisely, investors can enhance their portfolio’s diversification, potentially reducing overall risk while gaining exposure to the exciting world of digital assets.