Bitcoin Halving Cycles: What They Are and Why They Matter

Bitcoin halving cycles are one of the most crucial aspects of Bitcoin’s protocol, playing a key role in its monetary policy, supply dynamics, and long-term value proposition. If you’ve spent any time in the crypto space, you’ve likely heard of “the halving” — but what exactly is it, and why does it matter so much to Bitcoin’s future?

This article breaks down the concept of Bitcoin halving in full detail, explaining the mechanism, history, impacts, and what it means for investors, miners, and the entire cryptocurrency ecosystem.

What Is Bitcoin Halving?

Bitcoin halving refers to an event that occurs approximately every four years (or every 210,000 blocks) in which the reward that Bitcoin miners receive for validating transactions is cut in half.

✅ Current Bitcoin Block Reward:

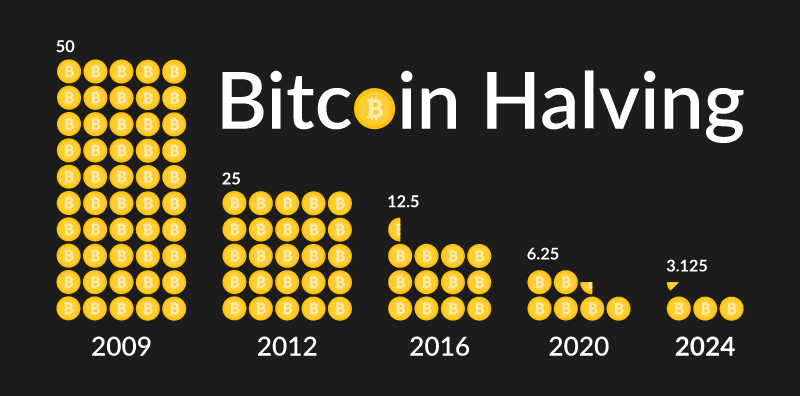

- When Bitcoin launched in 2009, the reward was 50 BTC per block.

- After the first halving in 2012, it dropped to 25 BTC.

- The second halving in 2016 reduced it to 12.5 BTC.

- The third halving in May 2020 brought it to 6.25 BTC.

- The next halving, expected in April 2024, will reduce the reward to 3.125 BTC.

This process will continue until the maximum supply of 21 million Bitcoins is reached — estimated to happen around the year 2140.

Why Does Bitcoin Halving Happen?

Bitcoin’s halving mechanism is built into its code by its pseudonymous creator, Satoshi Nakamoto. It’s a deliberate feature designed to:

- Control inflation by reducing the rate at which new bitcoins are created.

- Mimic scarce resources like gold, making Bitcoin a deflationary asset.

- Ensure longevity of mining incentives by gradually tapering rewards.

In traditional fiat systems, central banks can print more money, leading to inflation. Bitcoin, by contrast, has a fixed supply and predictable issuance schedule.

How Bitcoin Halving Works (Mechanics)

Bitcoin’s network creates a new block approximately every 10 minutes. Miners compete to solve cryptographic puzzles, and the winner adds the block to the blockchain and receives the block reward.

After every 210,000 blocks — roughly every four years — the code automatically reduces the block reward by 50%.

For example:

- Blocks 0 to 209,999 → 50 BTC

- Blocks 210,000 to 419,999 → 25 BTC

- Blocks 420,000 to 629,999 → 12.5 BTC

- Blocks 630,000 to 839,999 → 6.25 BTC (current phase)

Impact of Bitcoin Halving

1. Reduced Supply, Constant Demand → Price Pressure

By cutting the reward in half, the number of new bitcoins entering circulation is reduced. If demand remains steady or increases, simple economics suggests prices may rise due to scarcity.

Historically, Bitcoin prices have seen significant rallies after each halving.

2. Increased Mining Competition

As rewards shrink, only the most efficient miners can continue profitably. This pushes small players out, while large mining operations with better equipment and cheaper electricity stay in the game.

3. Shift in Market Sentiment

Each halving often brings heightened media attention and investor interest, which can create a self-fulfilling cycle of rising prices and hype. It’s not just a technical event — it’s a psychological and economic milestone.

Historical Bitcoin Halving Events and Market Reactions

🥇 First Halving – November 28, 2012

- Reward Cut: 50 → 25 BTC

- Price at Halving: ~$12

- 1 Year Later: ~$1,000

- Impact: Sparked Bitcoin’s first major bull run and brought it into broader awareness.

🥈 Second Halving – July 9, 2016

- Reward Cut: 25 → 12.5 BTC

- Price at Halving: ~$650

- 1 Year Later: ~$2,500 (eventually peaking at nearly $20,000 in Dec 2017)

- Impact: Launched the 2017 bull run and altcoin boom.

🥉 Third Halving – May 11, 2020

- Reward Cut: 12.5 → 6.25 BTC

- Price at Halving: ~$8,500

- 1 Year Later: ~$60,000

- Impact: Fueled institutional adoption and mainstream media coverage.

🥳 Upcoming Fourth Halving – Expected April 2024

- Reward Cut: 6.25 → 3.125 BTC

- Speculation: Many anticipate a new bull run based on previous patterns, but markets may behave differently this time.

Halving and the Stock-to-Flow Model

The Stock-to-Flow (S2F) model, made popular by analyst “PlanB,” measures the relationship between the current stock (existing supply) and the flow (new issuance).

Bitcoin’s S2F ratio increases dramatically after each halving, aligning with historical price increases. According to this model, scarcity is a key driver of Bitcoin’s value — similar to gold and silver.

Halving’s Impact on Miners

Miners face a 50% revenue cut overnight after a halving. This has serious implications:

- Profit margins shrink

- Increased reliance on transaction fees

- More emphasis on energy efficiency

- Consolidation in the mining industry

Some miners may shut down unprofitable operations, reducing the network’s hash rate temporarily until difficulty adjusts.

Halving: Risks and Criticisms

While many view halving as a bullish driver, there are criticisms and risks:

- Speculative Behavior: Price run-ups may lead to bubbles.

- Mining Centralization: Only large players may survive halving-induced cost pressure.

- Dependence on Price Increases: If prices don’t rise post-halving, miners may abandon the network.

- Uncertainty: Past performance does not guarantee future results.

Halving’s Role in Bitcoin’s Monetary Policy

The halving cycle is core to Bitcoin’s predictable and transparent monetary policy — unlike fiat currencies that can be manipulated.

- Fixed maximum supply: 21 million BTC

- Predictable issuance schedule: Halvings every 210,000 blocks

- Transparency: Anyone can verify the rules

This deflationary model is a major reason why Bitcoin is often compared to digital gold.

What Should Investors Know?

- Watch for Market Sentiment: Halvings often ignite renewed interest and FOMO (fear of missing out).

- Long-Term View: Post-halving rallies usually take months to unfold — patience is key.

- Minimize Emotional Decisions: Prices may dip temporarily before rising.

- Track Miner Behavior: Miners’ actions can influence price movements and network security.

Conclusion

Bitcoin halving cycles are more than just a technical rule — they are fundamental to how Bitcoin works, grows, and sustains itself. Each halving reduces the rate of new supply, increasing scarcity and often leading to a surge in interest, investment, and price.

As the next halving approaches, it’s important to stay informed and understand both the opportunities and the risks. While history shows that halvings often lead to bull markets, every cycle is different — and in the world of crypto, nothing is guaranteed.

Still, the halving remains one of the most anticipated events in the Bitcoin ecosystem and serves as a cornerstone of its unique economic model.