Best Cryptocurrencies for Long-Term Hold (HODL): A Comprehensive Guide

The cryptocurrency market is often associated with rapid gains and extreme volatility. However, beyond the speculative day-trading mania lies a class of assets that have demonstrated strong fundamentals and long-term potential. For investors with a long-term horizon, identifying and holding the right cryptocurrencies can lead to substantial wealth accumulation over time.

In this guide, we’ll explore:

- What long-term holding (HODLing) means

- Key traits of a good long-term crypto

- Top cryptocurrencies for long-term hold

- Risks and how to manage them

- Final thoughts

What is Long-Term Holding (HODLing)?

HODL is a slang term derived from a misspelled word “hold” in a 2013 Bitcoin forum post. Today, it means buying and holding a cryptocurrency regardless of market volatility, often for years. The philosophy is simple: ignore the daily noise and trust in the long-term growth of quality crypto projects.

What Makes a Good Long-Term Crypto Investment?

Before diving into the top picks, here are the essential factors that define a strong long-term crypto:

1. Strong Use Case

- Solves a real-world problem

- Has practical applications beyond speculation

2. Large and Growing Ecosystem

- Developer activity

- DApp (decentralized app) adoption

- Institutional or retail participation

3. Security and Network Stability

- Proven security over time

- Strong decentralization

4. Sustainable Tokenomics

- Reasonable supply schedule

- Inflation control mechanisms (burns, halvings)

5. Community and Governance

- Active community and transparent governance

- Community-led upgrades

6. Regulatory Resilience

- Projects that aim to comply with international regulations

- Projects with transparent foundations and teams

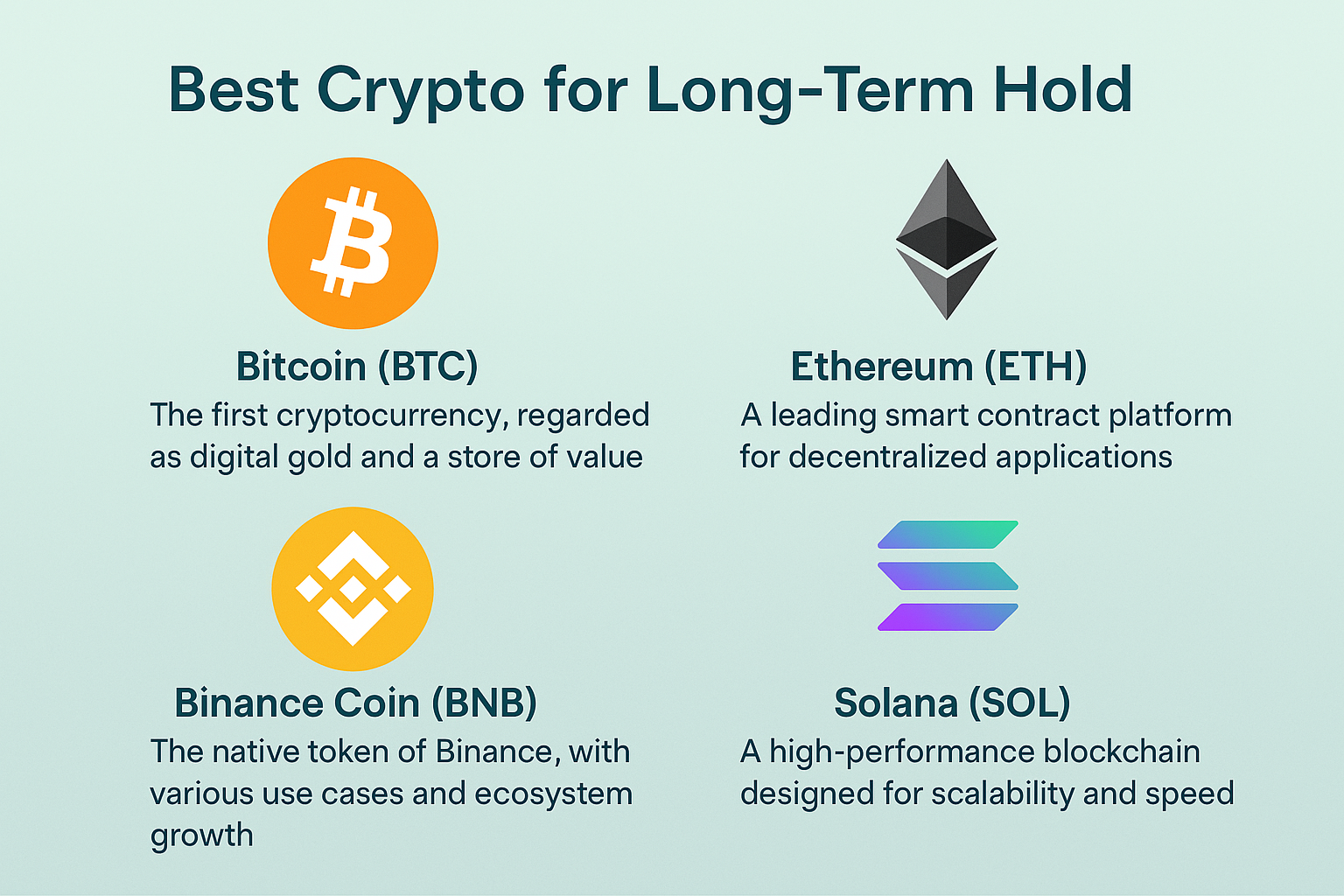

Top Cryptocurrencies for Long-Term Hold

Here are the most promising cryptos for long-term holding, based on fundamental strength and adoption.

1. Bitcoin (BTC) – The Digital Gold

Why Hold It Long-Term?

- First and most recognized cryptocurrency

- Limited supply of 21 million coins

- Institutional adoption is growing (e.g., ETFs, MicroStrategy, Tesla)

Use Case:

- Store of value, inflation hedge

- Censorship-resistant money

Long-Term Outlook:

With increasing interest from institutions, Bitcoin is often seen as the crypto equivalent of gold. It has survived multiple bear markets and has remained the most secure blockchain network.

2. Ethereum (ETH) – The Smart Contract Pioneer

Why Hold It Long-Term?

- Foundation for DeFi, NFTs, and DAOs

- Transitioned to Proof-of-Stake (Ethereum 2.0), improving scalability and efficiency

- Massive developer ecosystem

Use Case:

- Hosting decentralized applications

- Settlement layer for DeFi and NFTs

Long-Term Outlook:

Ethereum continues to dominate in utility and innovation. Layer 2 solutions like Optimism and Arbitrum are reducing fees, driving further adoption.

3. Solana (SOL) – The High-Speed Contender

Why Hold It Long-Term?

- Extremely fast transactions (65,000 TPS)

- Low fees

- Ecosystem growth (DeFi, NFTs, gaming)

Use Case:

- Scalable DApp platform

- Competes with Ethereum in performance

Long-Term Outlook:

Solana has recovered from major outages and proven resilience. If it continues improving infrastructure and gains more dApp adoption, it could be a top contender.

4. Chainlink (LINK) – The Oracle King

Why Hold It Long-Term?

- Most trusted oracle network

- Integrated with Ethereum, Polygon, BNB Chain, and more

- Expanding into CCIP (Cross-Chain Interoperability Protocol)

Use Case:

- Brings real-world data into smart contracts

- Enables DeFi protocols like lending and insurance

Long-Term Outlook:

As smart contracts continue to evolve, data integration becomes crucial. Chainlink is positioned as a fundamental infrastructure provider.

5. Polkadot (DOT) – The Multi-Chain Future

Why Hold It Long-Term?

- Built by Ethereum co-founder Dr. Gavin Wood

- Focuses on interoperability between blockchains

- Uses parachain architecture to scale effectively

Use Case:

- Connecting blockchains to share data and functionality

Long-Term Outlook:

If Web3 grows in a multi-chain direction, Polkadot’s ability to facilitate cross-chain communication will make it indispensable.

6. Cosmos (ATOM) – Internet of Blockchains

Why Hold It Long-Term?

- Competes directly with Polkadot for interoperability

- Hub-and-zone model allows sovereign chains to operate independently

Use Case:

- Interchain communication, DeFi, and governance tools

Long-Term Outlook:

With growing traction from ecosystems like Osmosis and the Cosmos SDK, ATOM could play a vital role in the decentralized internet of the future.

7. Arbitrum (ARB) – Ethereum’s Layer 2 Scaling

Why Hold It Long-Term?

- One of the leading Layer 2 networks on Ethereum

- Reduces gas fees and increases throughput

- Growing DeFi adoption

Use Case:

- Low-cost smart contracts execution

- Secure scalability solution

Long-Term Outlook:

If Ethereum dominates in the long term, successful Layer 2s like Arbitrum will become essential parts of the stack.

Honorable Mentions

- BNB (BNB): Binance’s native token, strong use in trading, staking, and fee payments.

- Avalanche (AVAX): Another fast blockchain with real-world adoption potential.

- Cardano (ADA): Slow development but strong academic and governance approach.

- Litecoin (LTC): Digital silver to Bitcoin’s gold.

Risks of Long-Term Crypto Holding

While HODLing can be rewarding, it’s not without risks:

🔴 Market Volatility

Prices can drop 50–80% in a bear market.

🔴 Regulation

Sudden regulatory changes can hurt even good projects.

🔴 Project Failure

Not all projects survive in the long run.

🔴 Security Breaches

Smart contract vulnerabilities, bridge hacks, or user error.

How to Manage Risks

- Diversify across 4–8 quality projects

- Use cold wallets for secure storage

- Stay informed on project updates and ecosystem changes

- Rebalance periodically based on fundamentals

Conclusion: HODLing with Purpose

Long-term crypto investing is not about blind hope — it’s about identifying projects with real-world value, strong teams, growing ecosystems, and solid use cases. Bitcoin and Ethereum remain foundational assets, while Layer 1s, Layer 2s, and infrastructure projects like Chainlink and Polkadot offer additional upside.

Build your portfolio thoughtfully, hold with conviction, and remember: time in the market often beats timing the market — especially in crypto.