🌉 Blockchain Bridges: Complete Guide to Cross-Chain Technology

As blockchain ecosystems continue to grow, the need for interoperability between different chains becomes increasingly vital. Today, there are thousands of decentralized applications (dApps) operating on numerous blockchain networks like Ethereum, Solana, BNB Chain, Avalanche, and more. However, these networks often operate in silos, making it difficult to transfer assets or data between them.

That’s where blockchain bridges come into play.

In this article, we’ll explore what blockchain bridges are, how they work, the types of bridges, their benefits, challenges, and some of the most popular bridge solutions in the market.

🔍 What is a Blockchain Bridge?

A blockchain bridge is a protocol that connects two different blockchain ecosystems and allows them to interact with one another. It enables the transfer of assets, data, or arbitrary information from one blockchain to another.

For example, if you have ETH on Ethereum and want to use it in an app on Avalanche, a bridge can lock your ETH on Ethereum and mint equivalent wrapped ETH (wETH) on Avalanche.

Bridges are crucial for enabling cross-chain communication and helping Web3 ecosystems become more interoperable.

🧠 Why Do We Need Blockchain Bridges?

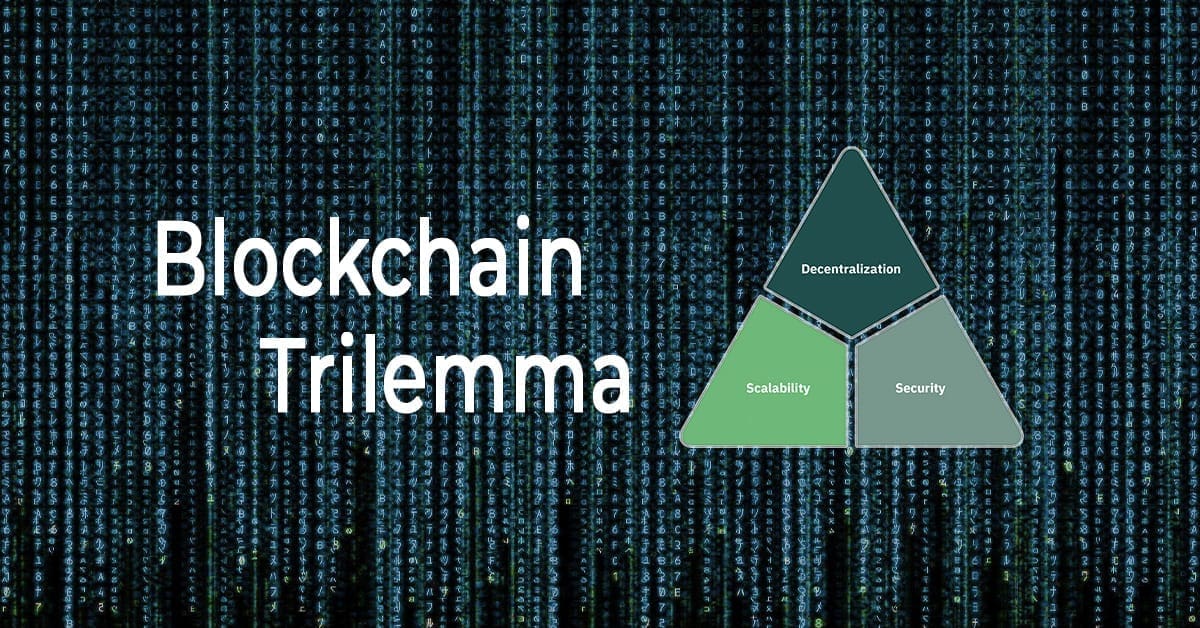

Blockchains were traditionally designed to be self-contained. Ethereum, Bitcoin, and others have their own consensus mechanisms, validators, and smart contract environments. This isolation creates friction for developers and users who want to:

- Move assets between chains

- Access features exclusive to other blockchains

- Leverage lower transaction fees or faster speeds on certain networks

- Build multi-chain dApps

Without bridges, ecosystems remain fragmented. Bridges unlock seamless cross-chain liquidity and utility, making the blockchain world more cohesive and efficient.

⚙️ How Do Blockchain Bridges Work?

While designs may vary, most bridges operate based on locking and minting (or burning and releasing) assets.

Example Flow:

- A user sends 1 ETH to the bridge on Ethereum.

- The bridge locks that ETH in a smart contract.

- The bridge mints a wrapped version of ETH (wETH) on another chain, like Avalanche.

- When the user wants to return to Ethereum, they burn the wETH on Avalanche.

- The bridge releases the original ETH on Ethereum.

This process is usually facilitated by a combination of smart contracts, oracles, and in some cases, validators or relayers who monitor transactions on both chains.

🧱 Types of Blockchain Bridges

Blockchain bridges vary depending on their level of decentralization, trust model, and design.

1. Trusted Bridges

These are operated by centralized entities or consortia. Users must trust that the bridge operator will behave honestly and not run off with funds.

Pros:

- Faster transactions

- Lower fees

- Easier to integrate

Cons:

- Centralization risk

- Custodial nature

Example: Binance Bridge

2. Trustless Bridges

These rely on smart contracts and algorithms to manage bridging without intermediaries. They are decentralized and align more closely with blockchain principles.

Pros:

- More secure (in theory)

- No need to trust a third party

Cons:

- Slower

- More complex

- Vulnerable to smart contract bugs

Example: Wormhole, Hop Protocol, Connext

3. Unidirectional vs. Bidirectional

- Unidirectional bridges only allow asset transfer one-way.

- Bidirectional bridges allow transfers both to and from a blockchain.

4. Chain-Specific vs. Generic Bridges

- Chain-specific bridges are built for one particular pair (e.g., ETH-BNB).

- Generic bridges support multiple chains and assets.

🔗 Popular Blockchain Bridges

Here are some of the most widely used blockchain bridges in the Web3 space:

🌪️ Wormhole

- Connects Solana to Ethereum, BNB Chain, Polygon, and others

- Used by dApps like Saber and Portal

🌉 Polygon Bridge

- Built by the Polygon team

- Allows users to move assets between Ethereum and Polygon

🛣️ Arbitrum Bridge

- Allows ETH and ERC-20 tokens to move from Ethereum to Arbitrum

- Used for L2 scaling

🔁 Hop Protocol

- Supports fast transfers across Ethereum L2s (Arbitrum, Optimism, Polygon)

- Trustless and uses optimistic rollups

🧬 Multichain (formerly Anyswap)

- Supports 70+ blockchains

- Known for high liquidity and wide compatibility

💡 Benefits of Blockchain Bridges

1. Interoperability

Bridges break down silos between chains, allowing ecosystems to interact and share value.

2. Scalability

Users can move assets to Layer 2s or faster blockchains to reduce fees and improve performance.

3. Liquidity Expansion

Enables capital to flow where it’s most productive, fueling DeFi and NFT markets across multiple chains.

4. Enhanced User Experience

Bridges let users access dApps and services across ecosystems without needing to stay on one chain.

⚠️ Risks and Challenges of Blockchain Bridges

While bridges are powerful tools, they also introduce significant risks:

1. Smart Contract Vulnerabilities

Bridges are complex and a prime target for hackers. Some of the biggest crypto hacks have involved bridge exploits.

Example: The Ronin Bridge hack on Axie Infinity resulted in over $600 million lost in 2022.

2. Centralization Risks

Some bridges are controlled by a small set of operators. If these are compromised, funds can be stolen or frozen.

3. Liquidity Fragmentation

Assets can exist in multiple wrapped forms across chains (e.g., wETH, ETH.e), causing confusion and liquidity splitting.

4. Slow Withdrawals

Trustless bridges often have delayed exit times due to fraud proofs or challenge periods.

🔮 The Future of Blockchain Bridges

The future of bridges lies in greater security, speed, and integration. Some upcoming innovations include:

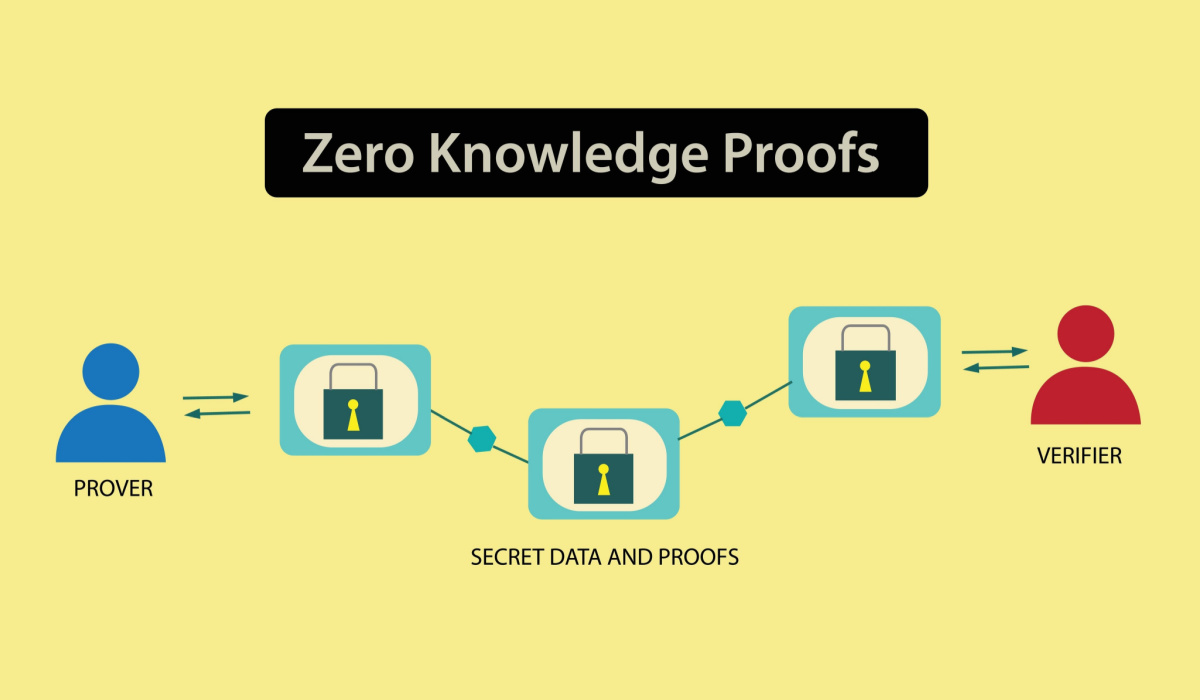

- Zero-knowledge bridges (ZK-bridges) for faster and more secure verification

- Unified liquidity protocols that abstract cross-chain swaps

- Native asset bridges built by the original blockchain teams

- Cross-chain messaging (e.g., LayerZero) for smart contract communication beyond just asset transfer

🧠 Final Thoughts

Blockchain bridges are essential infrastructure for the multichain future of crypto. They connect fragmented ecosystems, expand DeFi and NFT accessibility, and empower developers to build beyond the limits of a single chain.

However, bridges must evolve to address current security, decentralization, and user experience issues. Until then, users should always do their research and practice caution when moving assets across chains.