Dollar-Cost Averaging (DCA): A Complete Guide

Investing can often feel like navigating a storm — market volatility, emotional decisions, and complex strategies make it challenging for beginners and even seasoned investors. Among the most effective and time-tested approaches to mitigate these challenges is Dollar-Cost Averaging (DCA).

In this article, we’ll break down DCA from the ground up — what it is, how it works, why it’s useful, and how you can implement it across traditional and crypto markets. Whether you’re new to investing or looking to refine your strategy, DCA can be a valuable tool in your financial journey.

1. What Is Dollar-Cost Averaging (DCA)?

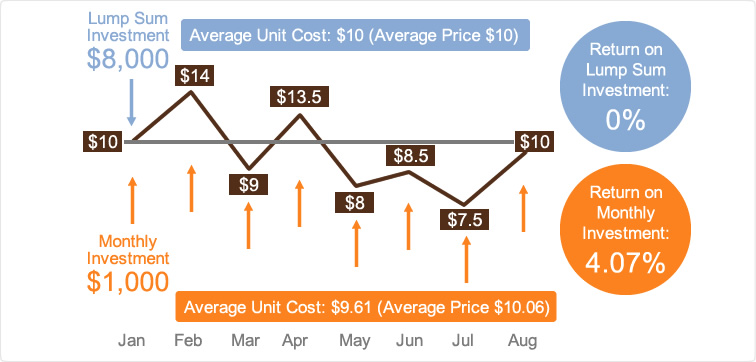

Dollar-Cost Averaging (DCA) is an investment strategy where you invest a fixed amount of money at regular intervals (e.g., weekly, monthly) into a particular asset, regardless of its price. Over time, this strategy reduces the impact of short-term volatility and eliminates the need to “time the market.”

Key Concept:

Instead of investing a large lump sum at once, DCA spreads out the purchase across multiple time points — buying more when prices are low, and less when prices are high.

2. How Does DCA Work?

Let’s say you decide to invest $100 every month into Bitcoin. Here’s what might happen over a few months:

| Month | BTC Price | Investment | BTC Purchased |

|---|---|---|---|

| Jan | $40,000 | $100 | 0.0025 BTC |

| Feb | $35,000 | $100 | 0.00286 BTC |

| Mar | $45,000 | $100 | 0.00222 BTC |

| Apr | $30,000 | $100 | 0.00333 BTC |

Over 4 months, you’ve invested $400. Your average purchase price isn’t the highest or lowest — it’s a dollar-weighted average, which smooths out volatility.

3. Benefits of Dollar-Cost Averaging

✅ Reduces Emotional Investing

DCA helps avoid emotional decisions like panic selling during crashes or FOMO buying during bull runs.

✅ Mitigates Market Timing Risk

Since no one can perfectly time the market, DCA removes the pressure of “buying at the right time.”

✅ Simple and Automatic

It’s easy to automate via apps and exchanges, making investing accessible even for beginners.

✅ Encourages Discipline

Investing regularly creates good financial habits, similar to monthly savings.

✅ Useful in Volatile Markets

In markets like cryptocurrency, where prices swing wildly, DCA reduces the impact of sharp up and down movements.

4. Drawbacks of Dollar-Cost Averaging

❌ May Miss Lump Sum Gains

In a consistent bull market, a one-time lump sum investment might yield higher returns than spreading it out.

❌ Requires Patience

DCA works best over longer time horizons — it’s not a get-rich-quick strategy.

❌ Fees Can Add Up

Frequent small purchases may incur higher cumulative transaction fees depending on the platform.

5. Lump Sum vs DCA: Which is Better?

Lump Sum:

- Pros: Potential for higher gains if market rises steadily.

- Cons: Greater risk if market drops right after investment.

DCA:

- Pros: Safer during volatile or declining markets.

- Cons: Slower accumulation and possible missed opportunities.

Studies show lump sum investing usually outperforms DCA in rising markets, but DCA wins psychologically and works better in volatile or uncertain markets.

6. DCA in Crypto: A Smart Strategy?

Crypto is notorious for its wild price swings. A Bitcoin investor in 2017, for instance, might have panicked when prices fell from nearly $20,000 to $3,000. However, someone using DCA would have continued accumulating BTC through both highs and lows.

Example: DCA into Bitcoin

If you had invested $50 weekly into BTC from January 2018 to January 2023 (5 years), you’d have invested $13,000. Despite huge volatility, your portfolio would be worth significantly more at Bitcoin’s 2023 prices — with much less stress.

7. Automating DCA

Most investment platforms offer DCA automation:

🔹 Crypto Exchanges

- Binance: Auto-Invest feature

- Coinbase: Recurring buys (daily, weekly, monthly)

- Kraken, OKX, Gemini: Similar scheduled buy options

🔹 Brokerage Apps

- Fidelity, Schwab, Vanguard: Set up recurring stock/ETF investments

🔹 Robo-Advisors

- Apps like Wealthfront and Betterment automatically apply DCA strategies with your chosen risk level.

8. Best Assets for DCA

While you can DCA into almost any asset, it works best with:

- Index Funds (e.g., S&P 500, Total Market ETFs)

- Blue-Chip Stocks

- Major Cryptocurrencies (e.g., BTC, ETH)

- Precious metals (via ETFs like GLD)

Avoid DCA into highly speculative or declining assets, as continuous investment into poor performers can lead to losses.

9. DCA vs Value Averaging

Another strategy is Value Averaging, where you invest more when prices are low and less when they’re high, targeting a specific portfolio value. It’s more complex than DCA and requires frequent adjustment.

| Strategy | Simplicity | Risk Management | Emotional Impact |

|---|---|---|---|

| DCA | High | Moderate | Low |

| Value Averaging | Medium | High | Medium |

| Lump Sum | Simple | High Risk | High |

10. Common DCA Mistakes to Avoid

❌ Stopping During Market Dips

Continue investing even when the market is down — that’s when you accumulate the most value.

❌ Using DCA on Bad Projects

Don’t blindly DCA into failing assets. Fundamentals still matter.

❌ Ignoring Transaction Fees

Use platforms with low fees or batch investments (e.g., monthly instead of weekly) if fees are too high.

❌ Expecting Quick Results

DCA works best over long periods — not days or weeks.

11. Real-Life DCA Success Story

Investor A starts investing $200/month in the S&P 500 ETF starting in 2010. By 2020, they have invested $24,000. Thanks to DCA and the overall market growth, their portfolio is worth over $40,000.

Investor B tried to time the market but bought during a peak and sold during a dip — ending with only $18,000. DCA not only generated higher returns but reduced stress and panic.

12. Conclusion: Is DCA Right for You?

Dollar-Cost Averaging is a powerful, proven strategy especially suited for long-term investors who:

- Don’t want to time the market

- Want to reduce emotional investing

- Prefer a set-it-and-forget-it approach

- Are investing in volatile markets like crypto

While it may not always outperform lump sum investing in strong bull markets, DCA is often the safest and most consistent way to build wealth over time — especially for beginners and those with a fixed monthly budget.

If you’re ready to start investing without stress, DCA might just be the best first step toward building a disciplined, long-term investment habit.