How Cryptocurrency is Created: Full Explanation

Cryptocurrency has revolutionized the way people perceive money, transactions, and financial freedom. While many are familiar with using or trading crypto, few understand how these digital currencies are actually created. Unlike fiat currencies printed by central banks, cryptocurrencies are typically created through decentralized systems using blockchain technology and cryptographic protocols. In this article, we will break down the different methods of crypto creation, including mining, staking, initial coin offerings (ICOs), airdrops, and token generation.

1. What is Cryptocurrency? (Brief Overview)

Cryptocurrency is a type of digital or virtual currency that uses cryptography for security. It is generally decentralized and operates on a technology called blockchain—a distributed ledger enforced by a network of computers (nodes).

The most well-known cryptocurrency is Bitcoin, but there are thousands of others like Ethereum, Litecoin, Cardano, Polkadot, and more. Each coin or token is created in a specific way, depending on its network design.

2. The Role of Blockchain in Crypto Creation

At the core of every cryptocurrency is blockchain technology. A blockchain is a digital ledger that records transactions in a series of blocks. Each block contains a group of transactions and is linked to the previous block, forming a chain. The network uses consensus mechanisms (like Proof of Work or Proof of Stake) to validate and add new blocks.

Whenever a new block is added to the blockchain, new cryptocurrency units may be created and rewarded to the entities that help validate the block. This is one of the fundamental ways cryptocurrencies are generated.

3. Methods of Creating Cryptocurrency

Let’s explore the most common methods used to create cryptocurrency:

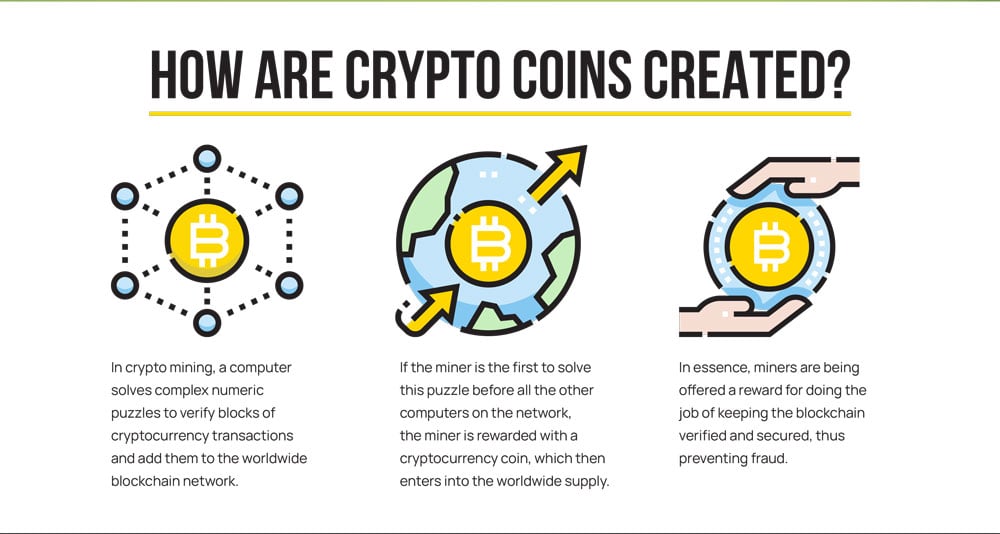

A. Mining (Proof of Work)

Crypto mining is the most traditional method of creating new cryptocurrency units, particularly used by Bitcoin and some other coins like Litecoin and Monero. It is based on the Proof of Work (PoW) consensus mechanism.

How it works:

- Miners use powerful computers to solve complex mathematical problems.

- These problems are part of a cryptographic algorithm that secures the network.

- The first miner to solve the problem validates the transaction and adds a new block to the blockchain.

- As a reward, the miner receives a specific number of newly minted coins. For example, Bitcoin currently rewards 6.25 BTC per block (subject to halving every 4 years).

Pros:

- High security and decentralization.

- Proven system (used by Bitcoin since 2009).

Cons:

- Energy-intensive.

- Requires specialized hardware (ASICs, GPUs).

- Slower and more expensive over time.

B. Staking (Proof of Stake)

Staking is another popular method of creating crypto, used in networks like Ethereum 2.0, Cardano, Solana, and Tezos. It uses the Proof of Stake (PoS) mechanism.

How it works:

- Participants, called validators, lock up (stake) a certain amount of their coins.

- Validators are randomly selected to validate transactions and create new blocks.

- In return, they receive rewards in the form of newly created cryptocurrency and transaction fees.

Pros:

- Energy-efficient compared to mining.

- Accessible with consumer hardware.

- Encourages holding coins (lowers volatility).

Cons:

- Wealth concentration (those with more coins have more influence).

- Less proven in the long term than PoW.

C. Initial Coin Offerings (ICOs) and Token Generation

ICOs are fundraising methods for new blockchain projects. They typically involve the creation of tokens rather than full cryptocurrencies (coins). The tokens are created on an existing blockchain like Ethereum using standards like ERC-20.

How it works:

- A startup develops a blockchain-based product or service.

- They create tokens that represent value or access rights.

- Investors buy these tokens using existing crypto (e.g., ETH or BTC).

- Tokens are created and distributed based on smart contracts.

Pros:

- Fast and easy to launch.

- Ideal for startups to raise capital.

Cons:

- High risk of scams or failed projects.

- Regulatory uncertainty in many countries.

D. Airdrops

Airdrops involve distributing free tokens to users, typically as a marketing strategy or a reward for participating in a community.

How it works:

- Developers create a new token.

- A portion of the total supply is allocated for free distribution.

- Users may need to complete certain tasks (like joining a Telegram group or following a Twitter account) or just hold a specific crypto wallet address.

Pros:

- Encourages adoption and awareness.

- No cost to the user.

Cons:

- Often low-value or spammy.

- Can be used for pump-and-dump schemes.

E. Forks

A fork occurs when a blockchain protocol is changed or split into two separate chains. This can result in the creation of a new cryptocurrency.

Example:

- Bitcoin Cash (BCH) was created through a hard fork of Bitcoin.

- Ethereum Classic (ETC) was formed after Ethereum split following the DAO hack.

When a fork occurs, users holding the original coin may receive an equal amount of the new coin, effectively creating new crypto units.

4. Token vs Coin Creation

- Coins are native to their blockchain (e.g., Bitcoin on Bitcoin blockchain, ETH on Ethereum blockchain).

- Tokens are created on top of existing blockchains using smart contracts (e.g., USDT, Chainlink).

Creating a token is generally easier and cheaper, as it doesn’t require building a new blockchain. Smart contract platforms like Ethereum, BNB Chain, and Solana allow anyone to create and launch a token using tools like Solidity (Ethereum’s programming language).

5. Crypto Minting Explained

“Minting” is a term often used interchangeably with “creation,” particularly in PoS networks and NFT (non-fungible token) creation. Minting refers to the process of generating new tokens and registering them on the blockchain.

In Proof of Stake systems, minting usually occurs when a validator proposes a new block and is rewarded with newly minted tokens.

In NFTs, minting is when a digital asset (like art, video, or music) is transformed into a blockchain-based asset.

6. How the Supply is Controlled

Many cryptocurrencies have predefined supply limits built into their code:

- Bitcoin has a hard cap of 21 million coins.

- Ethereum does not have a fixed supply, though recent upgrades have introduced a “burn” mechanism that reduces inflation.

- Some tokens are minted all at once (pre-mined) and distributed over time.

Supply control mechanisms help manage inflation, scarcity, and long-term value.

7. Regulatory Considerations

The creation of cryptocurrency is increasingly being scrutinized by regulators. Authorities may classify new tokens as securities, especially if they are issued through ICOs. It’s crucial for creators to ensure legal compliance in relevant jurisdictions to avoid legal issues.

Conclusion

Cryptocurrency is created through a variety of methods, each with its own technical and economic implications. Whether it’s through energy-intensive mining, staking in a Proof of Stake system, launching a token via an ICO, or distributing coins via airdrops, the creation process is deeply tied to blockchain technology and consensus protocols.

As blockchain networks evolve, so will the methods of creating and distributing cryptocurrencies. Understanding these processes is essential for anyone looking to get involved in the crypto space—whether as an investor, developer, or enthusiast.