The Difference Between Coin and Token: A Detailed Guide

In the world of cryptocurrency and blockchain technology, two terms often used interchangeably are “coin” and “token.” However, they are not the same. Understanding the differences between coins and tokens is essential for anyone looking to invest in crypto, build blockchain projects, or simply expand their knowledge of the digital finance space.

In this article, we’ll explore the fundamental differences, use cases, technical structures, advantages, and risks associated with coins and tokens. Whether you’re a beginner or a seasoned crypto enthusiast, this guide will provide valuable insights.

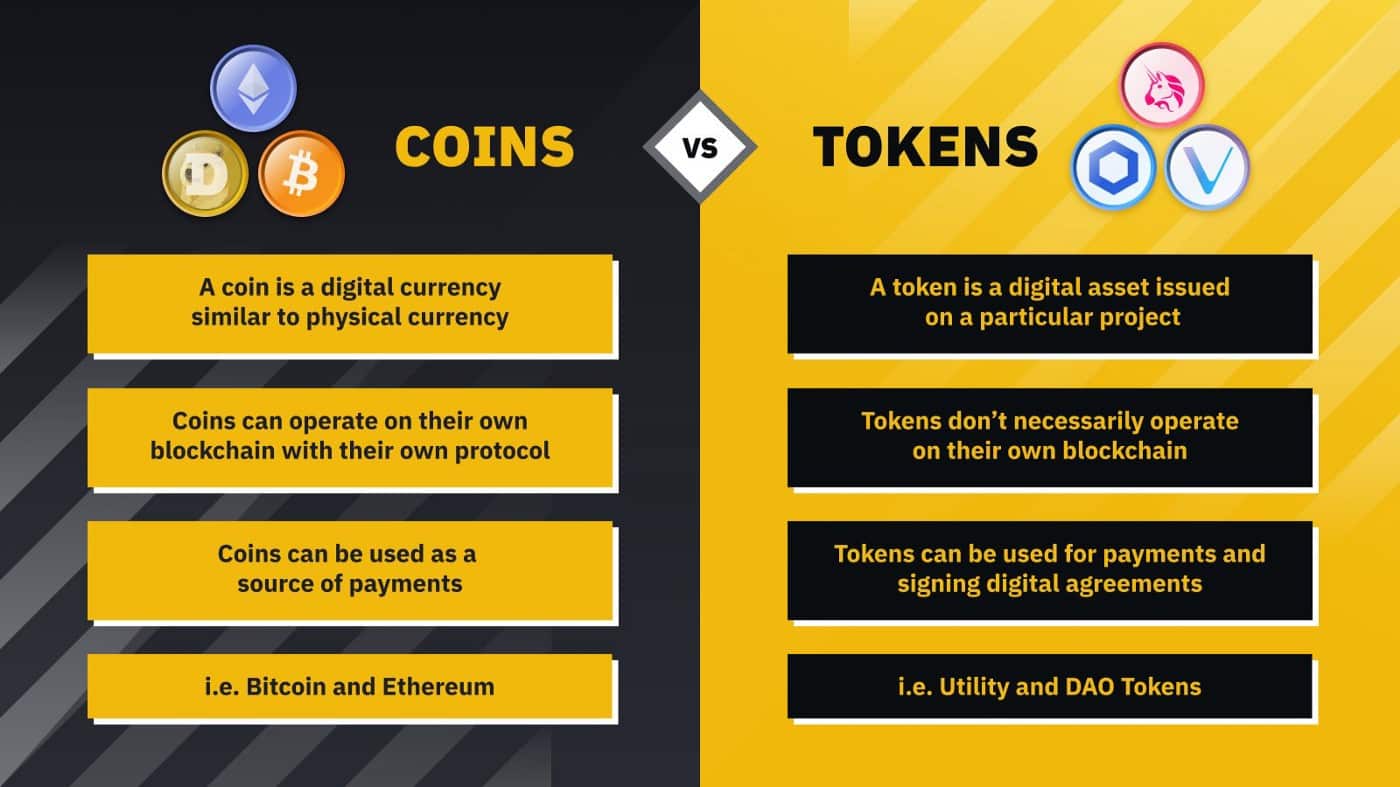

📌 Definition: What is a Coin?

A coin is a cryptocurrency that operates on its own native blockchain. It is a digital currency used primarily as a store of value, medium of exchange, and sometimes a unit of account.

Coins are typically the primary assets of their respective blockchains. For example:

- Bitcoin (BTC) runs on the Bitcoin blockchain

- Ether (ETH) runs on the Ethereum blockchain

- BNB runs on the BNB Chain (formerly Binance Smart Chain)

Coins function similarly to traditional currencies, but without centralized control by governments or banks.

✅ Key Characteristics of Coins:

- Native to their own blockchain

- Used to pay transaction (gas) fees

- Can be mined or staked (depending on consensus model)

- Often serve as the network’s primary incentive

📌 Definition: What is a Token?

A token is a cryptocurrency that is built on an existing blockchain. It does not have its own native blockchain and instead relies on a host chain’s infrastructure.

Tokens are created using smart contracts, and they can represent anything from assets, utilities, governance rights, loyalty points, or even real-world assets.

For example:

- Uniswap (UNI) – a governance token on the Ethereum blockchain

- USDT (Tether) – a stablecoin issued on Ethereum, Tron, and others

- ApeCoin (APE) – a utility/governance token on Ethereum

✅ Key Characteristics of Tokens:

- Built on top of existing blockchains (e.g., Ethereum, BNB Chain, Solana)

- Created via smart contracts (commonly ERC-20, BEP-20, etc.)

- Can represent various assets or utilities beyond currency

- Cannot operate independently without the host blockchain

🔍 Blockchain Examples: Coins vs. Tokens

| Blockchain Platform | Native Coin | Example Tokens |

|---|---|---|

| Bitcoin | BTC | (Coins only) |

| Ethereum | ETH | USDT, LINK, UNI, AAVE |

| Solana | SOL | SRM, RAY |

| BNB Chain | BNB | CAKE, SAFEMOON |

⚙️ Technical Differences

1. Blockchain Ownership

- Coins: Operate on their own blockchain, maintained by a distributed network of nodes.

- Tokens: Use someone else’s blockchain and abide by its rules.

2. Creation Method

- Coins: Require development of a full blockchain protocol from scratch or via fork.

- Tokens: Can be created quickly using pre-existing blockchain protocols and templates (e.g., ERC-20).

3. Transaction Fee Payments

- Coins: Can pay for their own network fees.

- Tokens: Need the host blockchain’s native coin to pay gas fees (e.g., ETH for ERC-20 tokens).

🧠 Different Types of Tokens

Tokens come in various forms depending on their purpose and functionality:

1. Utility Tokens

These provide access to a product or service within a specific blockchain platform.

- Example: BNB on Binance platform for trading discounts

2. Security Tokens

These represent ownership in a company or project, similar to traditional securities (stocks, bonds).

- Example: tZERO token

3. Governance Tokens

Used to vote on project decisions, proposals, or upgrades.

- Example: UNI for Uniswap DAO governance

4. Stablecoins

Tokens pegged to real-world assets like fiat currency to reduce volatility.

- Example: USDT, USDC

5. Non-Fungible Tokens (NFTs)

Unique tokens that represent ownership of digital items or assets.

- Example: CryptoPunks, Bored Ape Yacht Club

💰 Use Cases

✅ Coins are mainly used for:

- Peer-to-peer transactions (like Bitcoin)

- Payment for goods and services

- Network governance and staking

- Collateral in DeFi protocols

✅ Tokens are mainly used for:

- Access to decentralized apps (dApps)

- Voting rights in decentralized autonomous organizations (DAOs)

- Rewards in play-to-earn (P2E) games

- Digital ownership in NFT marketplaces

- Asset representation (stocks, gold, fiat)

🔐 Security & Regulation

- Coins usually have more robust security due to the maturity and scale of their networks.

- Tokens can be more vulnerable if created poorly or used in malicious projects (e.g., rug pulls or exit scams).

- Regulatory agencies like the SEC have shown greater interest in security tokens and may classify some tokens as investment contracts.

📉 Risks Involved

| Aspect | Coins | Tokens |

|---|---|---|

| Security | More mature and tested | Depends on smart contract integrity |

| Volatility | Can still fluctuate heavily | Often even more volatile |

| Project Risk | Backed by robust infrastructure | Many tokens are experimental or short-lived |

| Regulatory Risk | Generally clearer classification | May fall under securities law |

💬 Coin vs Token: An Analogy

Think of a coin as a standalone operating system (like Windows or macOS). It’s a foundational layer.

A token is like an app that runs on that operating system (like Microsoft Word on Windows).

- Bitcoin is like building your own computer and operating system from scratch.

- A token like Uniswap (UNI) is like building a website or app on top of existing web infrastructure like AWS.

🧾 How to Know If It’s a Coin or Token?

Ask these questions:

- Does it operate on its own blockchain? → Coin

- Is it dependent on another blockchain? → Token

- Can you mine or stake it natively? → Coin

- Do you need another coin to pay gas fees? → Token

🚀 Which One Should You Invest In?

There’s no one-size-fits-all answer. It depends on your investment goals, risk tolerance, and research.

- Coins are generally more stable and serve as a base-layer investment (e.g., BTC, ETH).

- Tokens may offer higher growth potential but also come with increased risk.

A diversified portfolio might contain both.

✅ Conclusion

Understanding the distinction between coins and tokens is fundamental in navigating the complex world of blockchain and cryptocurrencies. While both serve critical roles in the digital economy, they differ in infrastructure, use cases, and risk profiles.

To recap:

- Coins = Native to their own blockchain (e.g., BTC, ETH)

- Tokens = Built on top of another blockchain (e.g., USDT, UNI)

As the Web3 space continues to evolve, more creative uses for both coins and tokens will emerge. Keeping up with these developments is crucial for users, developers, and investors alike.

Pro Tip: Before investing in any coin or token, always conduct thorough due diligence. Check the team, utility, technology, and community support.