🔍 What is Leverage Trading in Crypto? A Complete Guide (2025)

Leverage trading is one of the most powerful tools in the world of cryptocurrency, enabling traders to potentially multiply their profits—but it also comes with significant risks. In this comprehensive guide, we’ll explore everything you need to know about leverage trading: what it is, how it works, where it’s used, its pros and cons, and the best practices for trading responsibly.

📌 What is Leverage Trading?

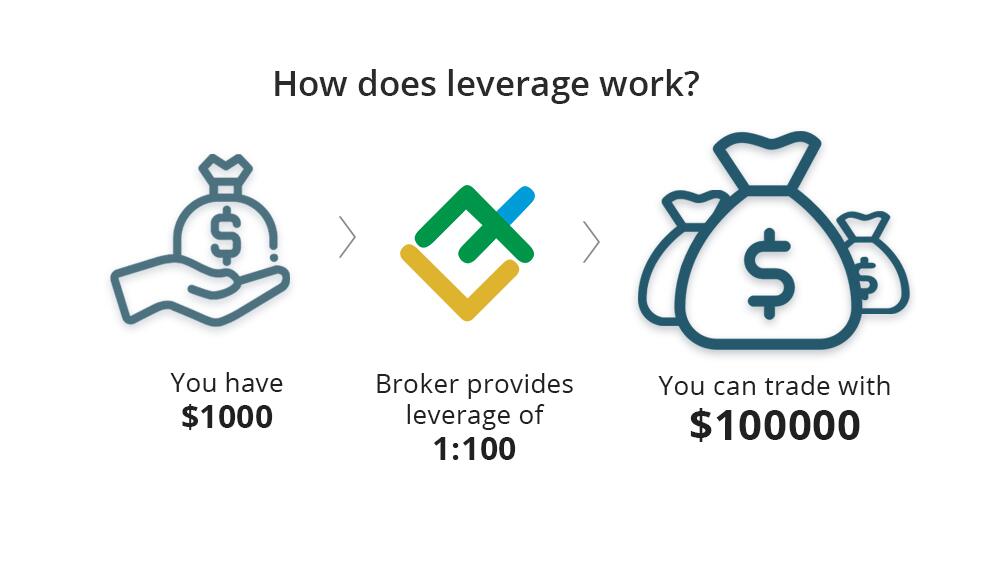

Leverage trading (also known as margin trading) allows traders to borrow funds to increase the size of their trading position. It’s like using a loan from the exchange or broker to trade with more capital than you actually own.

For example, if you have $1,000 and use 10x leverage, you can open a position worth $10,000. If the trade goes your way, your profits are amplified. But if it goes against you, your losses are also magnified.

🔁 How Leverage Trading Works

Basic Concept:

- Leverage is expressed as a ratio, such as 2x, 5x, 10x, 50x, or even 100x.

- Margin is the actual amount of capital you commit to a trade.

Let’s say:

- You open a long position on Bitcoin with 10x leverage.

- You invest $1,000 of your own capital (margin), so the position size becomes $10,000.

- If BTC goes up 10%, you make a 100% profit on your margin, i.e., $1,000.

- If BTC drops 10%, your margin is wiped out, and your position is liquidated.

🧠 Key Terms to Know

- Long Position: You’re betting the asset’s price will rise.

- Short Position: You’re betting the asset’s price will fall.

- Liquidation: Happens when your losses exceed your margin—your position is forcibly closed to prevent further losses.

- Maintenance Margin: The minimum amount of equity needed to keep a leveraged position open.

- Initial Margin: The capital you need to open a position.

📈 Leverage Examples in Crypto

Let’s look at two real-world scenarios:

Scenario 1 – Profitable Trade

- Trader uses $2,000 with 5x leverage = $10,000 position on ETH.

- ETH price rises 10%.

- Position value: $11,000 → profit: $1,000.

- ROI on capital: 50% ($1,000 / $2,000).

Scenario 2 – Losing Trade

- Same setup as above.

- ETH price drops 10%.

- Position value: $9,000 → loss: $1,000.

- Margin falls below maintenance level, triggering liquidation.

⚙️ Where Can You Use Leverage in Crypto?

Many centralized and decentralized exchanges offer leverage trading:

Centralized Exchanges (CEXs)

- Binance: Up to 125x leverage for futures.

- Bybit: Up to 100x for perpetual contracts.

- OKX, Bitget, KuCoin: All support derivatives and margin trading.

Decentralized Exchanges (DEXs)

- dYdX: Offers perpetual contracts with leverage.

- GMX: Leverage on-chain using liquidity pools.

- Synthetix: Offers synthetic asset trading with leverage.

🔄 Types of Leverage Trading Products

| Product Type | Description |

|---|---|

| Spot with Margin | Borrow funds to buy/sell assets directly in the spot market. |

| Futures Contracts | Agreement to buy/sell assets at a later date at a fixed price. |

| Perpetual Swaps | No expiry date; mimic spot prices with funding fees. |

| Options | Contracts that give rights (not obligation) to buy/sell at a specific price. |

💸 Benefits of Leverage Trading

1. Higher Profit Potential

Leverage magnifies gains, which is attractive in a volatile market like crypto.

2. Capital Efficiency

You don’t need large capital to open large positions.

3. Hedging

Advanced traders can use leverage to hedge spot holdings.

4. Shorting Opportunity

You can profit even when the market drops by going short.

⚠️ Risks of Leverage Trading

1. Liquidation Risk

Small price fluctuations can wipe out your position.

2. Market Volatility

Crypto is highly volatile, making leverage risky even for pros.

3. Psychological Pressure

High stakes can lead to emotional trading and poor decisions.

4. Funding Fees

Perpetual contracts charge fees for keeping positions open, especially with high leverage.

📊 Risk Management in Leverage Trading

✅ Use Stop-Loss Orders

Always define your exit points to avoid total loss.

✅ Start with Low Leverage

Begin with 2x–5x to reduce liquidation risk.

✅ Never Use 100% of Your Capital

Only risk what you can afford to lose.

✅ Monitor Liquidation Price

Understand how close your entry is to being wiped out.

✅ Diversify

Don’t put your entire portfolio into a single leveraged trade.

💼 Who Uses Leverage Trading?

- Day Traders: Looking to capitalize on short-term price movements.

- Institutional Investors: Use it for hedging or portfolio management.

- DeFi Enthusiasts: Exploring leverage via on-chain protocols.

🛠 Tools and Platforms for Leverage Trading

Top Platforms:

- Binance Futures: High liquidity and professional tools.

- Bybit: Fast execution, copy trading, education resources.

- dYdX: Decentralized, non-custodial, with advanced trading features.

Tools to Assist:

- TradingView: Charting platform to test strategies.

- Coinglass: Track liquidations and funding rates.

- CryptoQuant: On-chain data for informed decisions.

📅 Leverage and Market Conditions

Bull Market:

- More traders use leverage to amplify profits.

- Liquidations can spike on sudden corrections.

Bear Market:

- Leverage becomes riskier as prices drop.

- Often used to short the market.

🧾 Regulatory Considerations

Some countries have restricted leverage trading due to its high-risk nature:

- EU (ESMA): Retail crypto leverage often capped at 2x.

- US (CFTC): Regulated platforms must comply with leverage rules.

- Japan, UK, and others: Strict oversight on leveraged products.

🤔 Is Leverage Trading Right for You?

Ask yourself:

- Do I understand the risks involved?

- Am I comfortable losing the entire margin?

- Do I have a strategy and risk management system?

If you’re new to crypto, paper trading or demo accounts on platforms like Bybit and Binance are excellent ways to practice without risking real money.

✅ Final Thoughts

Leverage trading is a double-edged sword. While it can dramatically boost your gains, it can also result in catastrophic losses. It’s essential to learn the mechanics, study the market, and implement robust risk management techniques.

If you’re ready to take the plunge, start small, stay informed, and trade responsibly.