Copy Trading in Forex: A Complete Guide for Beginners

Introduction

Forex (foreign exchange) trading offers vast opportunities, but many beginners find it challenging due to market complexity and the skills required. This is where copy trading comes in — a method that allows you to automatically copy the trades of professional or experienced traders.

In this guide, we’ll explore everything you need to know about copy trading in Forex, including how it works, the best platforms, risks, and how you can start your journey with minimal experience.

What is Copy Trading?

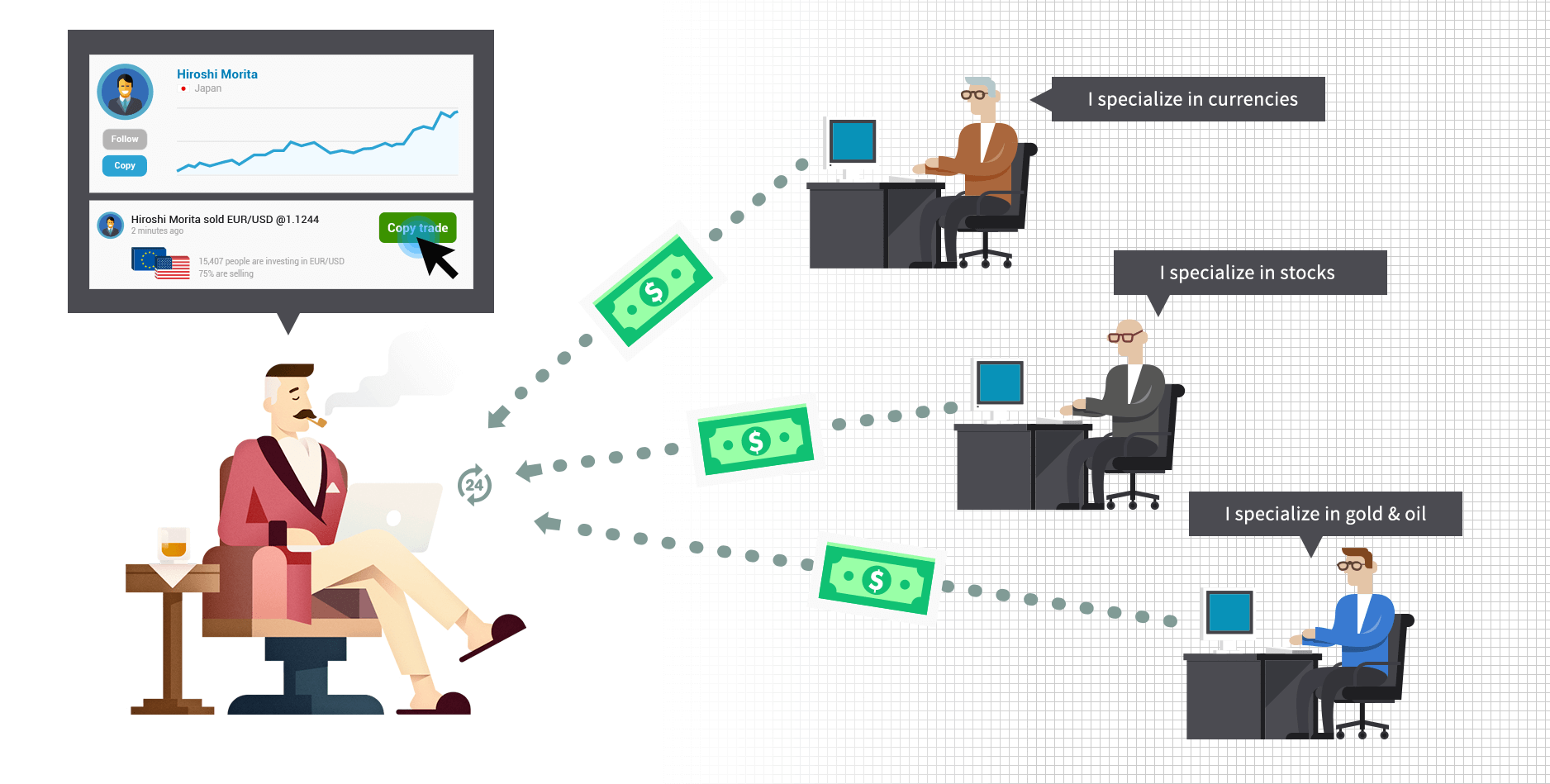

Copy trading is a form of social trading where one trader (the “follower” or investor) replicates the trades of another trader (the “signal provider” or pro trader) in real-time. Once the trader you are copying opens or closes a position, the same action is automatically executed in your account proportionally.

🔁 Key Concept:

You don’t need to trade manually. You choose a trader to copy, and your account mimics their actions.

How Copy Trading Works in Forex

- Sign Up with a Platform: You register with a broker or platform that offers copy trading.

- Browse Traders: Use filters like risk level, profit percentage, trading style, and more to find a trader to copy.

- Allocate Funds: Assign a portion of your capital to copy that trader.

- Automatic Execution: Every time the trader opens/closes a trade, it reflects in your account automatically.

- Performance Tracking: You can track the trader’s performance, pause, or stop copying anytime.

Copy Trading vs Social Trading vs Mirror Trading

| Type | Description |

|---|---|

| Copy Trading | You replicate the exact trades of a selected trader in real time. |

| Social Trading | You follow traders, discuss strategies, and decide manually whether to copy their trades. |

| Mirror Trading | You follow a predefined strategy, usually algorithm-based, that mirrors trades into your account. |

Benefits of Copy Trading in Forex

✅ 1. Easy for Beginners

No need for deep technical knowledge or experience in Forex trading. You can benefit from someone else’s expertise.

✅ 2. Saves Time

You don’t have to spend hours analyzing the market — just follow successful traders.

✅ 3. Diversification

You can copy multiple traders with different strategies and risk profiles, reducing overall risk.

✅ 4. Transparent Results

Most platforms provide detailed stats like win rate, drawdown, average returns, and number of followers.

✅ 5. Passive Income Potential

As your chosen trader makes profits, so do you, making this a passive investment tool.

Risks and Drawbacks of Copy Trading

❌ 1. Losses Are Still Possible

If the trader you’re copying loses money, you will too. Past performance is not a guarantee of future results.

❌ 2. Lack of Control

Once you copy a trader, you don’t control individual trades unless you manually intervene.

❌ 3. Over-Reliance

Relying solely on copy trading might prevent you from learning how to trade yourself.

❌ 4. Hidden Fees

Some platforms charge performance fees or increased spreads. Always read the fine print.

Top Forex Copy Trading Platforms in 2025

Here are some of the most trusted platforms offering copy trading in Forex:

🥇 1. eToro

- Regulated in multiple countries.

- User-friendly social trading interface.

- Real trader stats, performance, risk score.

- Offers CopyTrader and CopyPortfolios.

🥈 2. ZuluTrade

- Compatible with multiple brokers.

- Allows copying forex, crypto, indices, and stocks.

- Provides rankings, trader reviews, and risk metrics.

🥉 3. MetaTrader 4/5 (via Signals)

- Built-in signal copying feature.

- Widely used platform with thousands of signal providers.

- Customizable and suitable for advanced users.

4. Myfxbook AutoTrade

- Integrates with verified Myfxbook accounts.

- Copy only systems with real trading history.

- Offers transparency and performance analytics.

5. DupliTrade

- Premium copy trading platform.

- Works with regulated brokers.

- Automated execution based on chosen strategies.

Types of Traders You Can Copy

When choosing a trader, pay attention to:

- Win Rate: Percentage of winning trades.

- Drawdown: How much capital the trader loses before recovering.

- Trading Style: Scalping, day trading, swing trading, or long-term.

- Consistency: Look for traders with steady returns over time.

- Risk Profile: Conservative or aggressive.

How Much Money Do You Need to Start?

- Most platforms allow minimum investments between $100–$500.

- You can usually set stop-loss limits to protect your capital.

- It’s best to start small and scale gradually.

How to Start Copy Trading in Forex (Step-by-Step)

Step 1: Choose a Copy Trading Platform

Select a regulated broker/platform like eToro, ZuluTrade, or Myfxbook AutoTrade.

Step 2: Open and Fund Your Account

Register, verify your identity, and deposit funds via bank transfer, credit card, or e-wallet.

Step 3: Browse and Analyze Traders

Use filters to sort by risk score, ROI, number of followers, etc.

Step 4: Allocate Funds to Copy

Decide how much to invest per trader. You can copy multiple traders for diversification.

Step 5: Monitor Performance

Track profits, adjust allocations, or stop copying if needed.

Tips for Success in Copy Trading

- ✅ Diversify: Don’t put all your money on one trader.

- ✅ Start Small: Test the waters with minimum investment.

- ✅ Set Stop Loss: Protect your capital from unexpected drops.

- ✅ Check Trader Behavior: Are they consistent or overly risky?

- ✅ Avoid Emotional Traders: Look for those who follow a clear strategy.

- ✅ Reinvest Wisely: Compound your earnings by reinvesting profits.

Is Copy Trading Legal and Safe?

Yes, in most countries. However:

- Only use regulated brokers/platforms.

- Beware of scams or Ponzi schemes promising guaranteed returns.

- Research before investing and understand platform terms.

Frequently Asked Questions (FAQ)

❓ Can I lose money with copy trading?

Yes. If the trader you’re copying loses money, you also incur the loss. Always invest cautiously.

❓ Is copy trading passive income?

Yes, it can be. Once set up, trades are copied automatically. However, periodic monitoring is advised.

❓ Can I manually close a copied trade?

Most platforms allow manual intervention. You can stop copying a trader or close a trade anytime.

❓ Are profits taxable?

Yes. Forex profits are usually subject to capital gains tax or income tax, depending on your country’s laws.

Conclusion

Copy trading in Forex is an excellent way for beginners to enter the market with minimal effort and benefit from the experience of professionals. However, it’s important to choose the right trader, understand the risks, and monitor your investments regularly.

With the right strategy and platform, copy trading can become a smart passive income stream and a stepping stone to eventually learning Forex trading on your own.