Elliott Wave Theory in Forex: A Complete Guide for Traders

Forex traders often seek methods to forecast price movements with greater precision. One of the most powerful and time-tested technical analysis tools is Elliott Wave Theory. Developed by Ralph Nelson Elliott in the 1930s, this theory is built on the idea that financial markets move in repetitive wave patterns influenced by investor psychology.

This article explores how Elliott Wave Theory works in Forex, the different wave patterns, how to apply them, and what traders should consider when using this tool.

📌 What Is Elliott Wave Theory?

Elliott Wave Theory posits that market prices move in waves, which are a direct reflection of collective investor behavior or crowd psychology. According to the theory, price movements are not random but instead follow natural patterns of expansion and contraction that repeat over time.

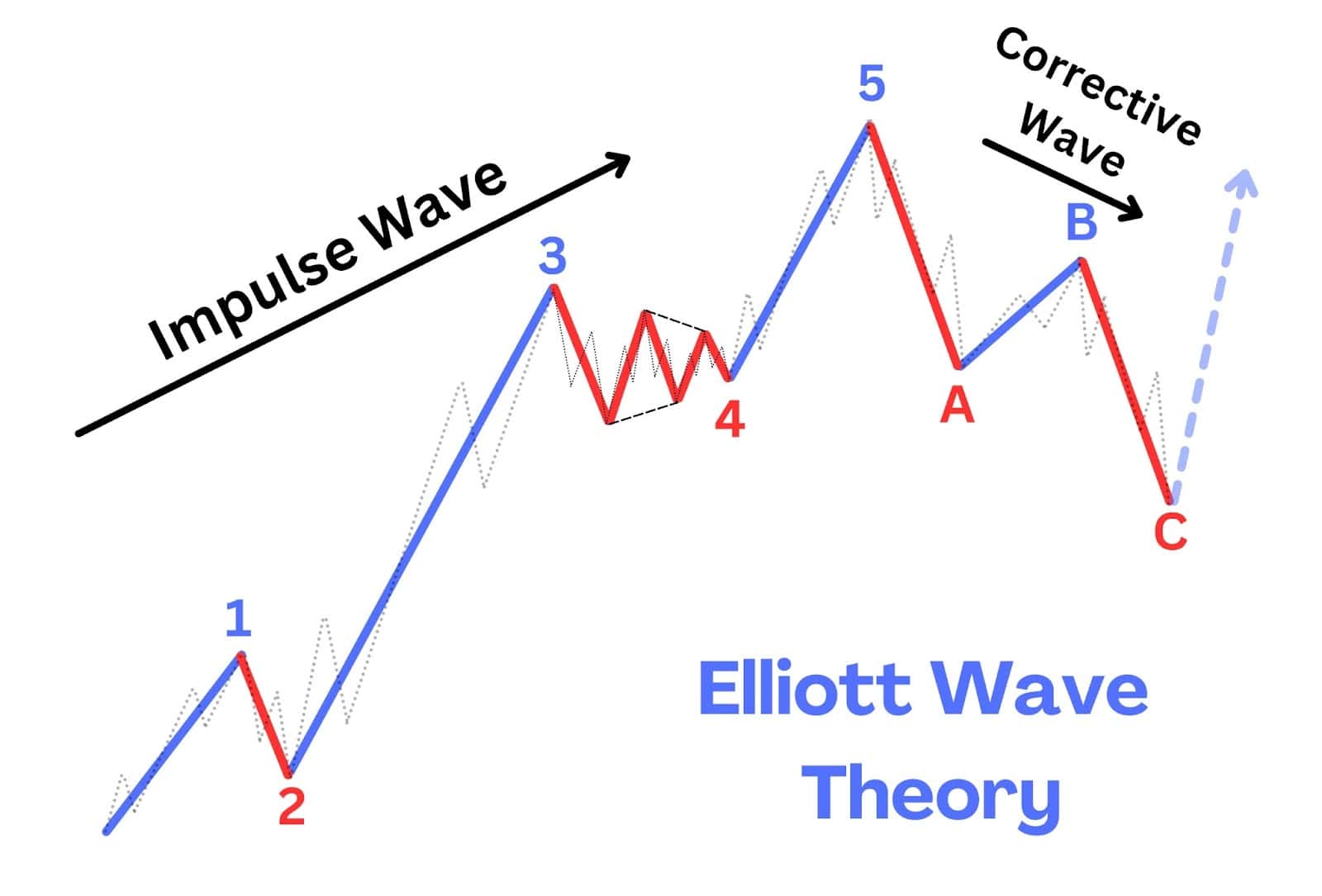

The waves are structured in a five-wave motive sequence followed by a three-wave corrective sequence, forming a complete market cycle.

🔄 The Two Main Types of Elliott Waves

1. Impulse (Motive) Waves

Impulse waves move in the direction of the overall trend and consist of five distinct sub-waves:

- Wave 1: The initial move in the trend direction

- Wave 2: A retracement or pullback

- Wave 3: The strongest and longest wave in most cases

- Wave 4: Another retracement, usually weaker than Wave 2

- Wave 5: The final move in the trend before a reversal or correction

🧠 Rule: Wave 3 can never be the shortest wave.

2. Corrective Waves

Corrective waves move against the trend and typically consist of three sub-waves labeled A, B, and C:

- Wave A: Initial counter-trend move

- Wave B: Small retracement of A

- Wave C: Final move completing the correction

These corrective waves can take on various forms, including zigzags, flats, and triangles.

🌀 The Elliott Wave Cycle

When combined, impulse and corrective waves form a complete cycle of 8 waves:

- 5 waves in the direction of the main trend (1, 2, 3, 4, 5)

- 3 waves correcting the trend (A, B, C)

Each of these waves can be further broken down into smaller sub-waves—known as the fractal nature of Elliott Wave Theory.

⏳ Time Frames and Elliott Waves

Elliott Wave Theory works across all time frames:

- Daily or Weekly Charts: Identify major trend waves

- 1-Hour or 4-Hour Charts: Spot entry and exit points

- 15-Minute Charts: Analyze short-term trade setups

The key is to match the wave count with the time frame and market context you’re trading.

🔍 How to Identify Elliott Waves in Forex

- Find the dominant trend (uptrend or downtrend).

- Look for the 5-wave impulse structure.

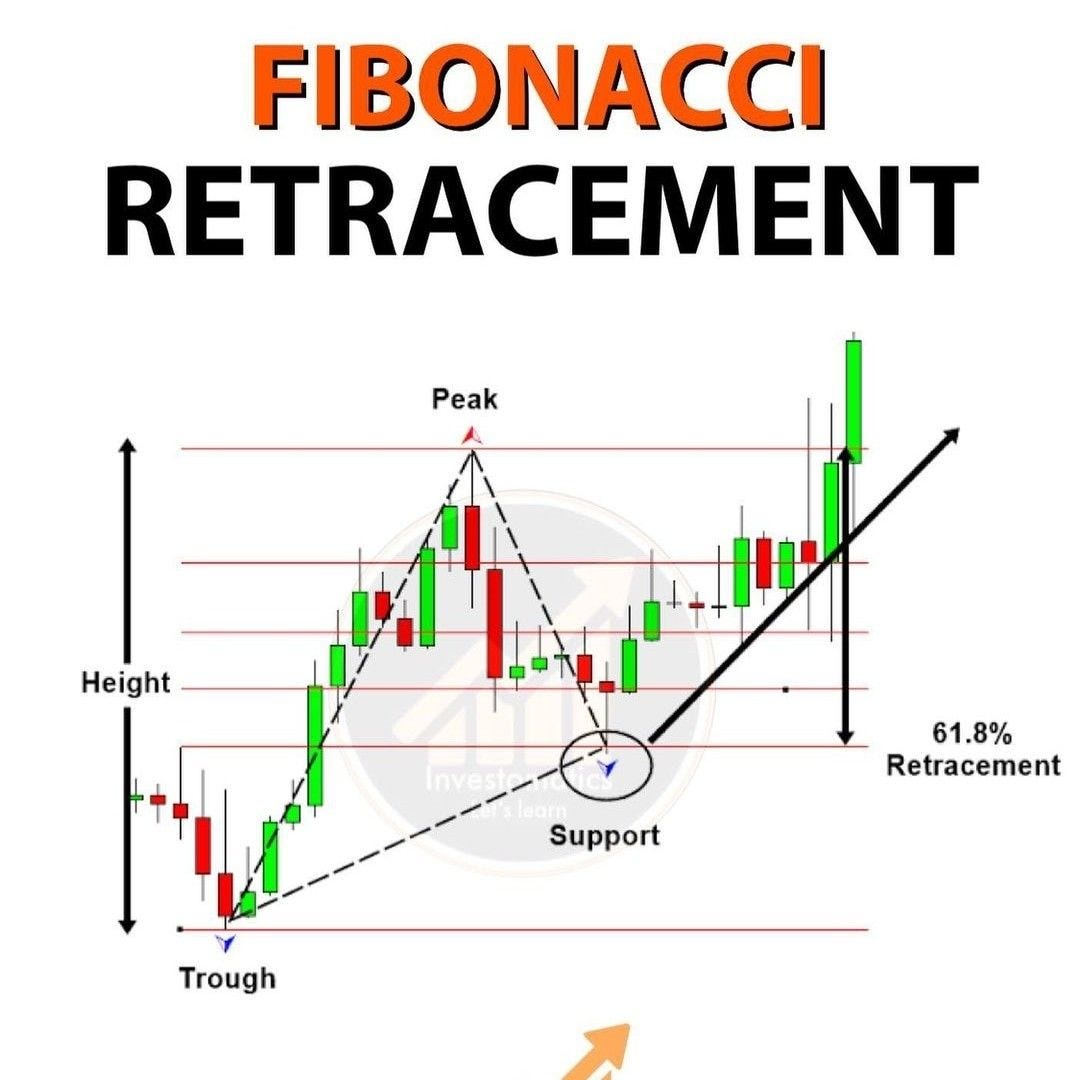

- Use Fibonacci retracement and extension tools to validate waves.

- Wait for the 3-wave correction (ABC) before entering a new trade in the trend direction.

✅ Tip: Elliott Wave counts are subjective, so using validation tools like Fibonacci, RSI divergence, or trendlines is crucial.

📐 Types of Corrective Patterns

Elliott Wave corrections are more complex than impulses. Let’s look at common types:

🔁 Zigzag (5-3-5)

- A sharp correction where Wave A and C are impulses, and Wave B is corrective.

⬛ Flat (3-3-5)

- A sideways market with Wave A and B being three-wave moves and Wave C forming an impulse.

🔺 Triangle (3-3-3-3-3)

- A consolidation structure before a breakout. Can be ascending, descending, or symmetrical.

🧮 Using Fibonacci with Elliott Waves

Fibonacci ratios are integral to Elliott Wave analysis:

- Wave 2 typically retraces 50%–61.8% of Wave 1.

- Wave 3 often extends 161.8% of Wave 1.

- Wave 4 retraces 23.6%–38.2% of Wave 3.

- Wave 5 can equal Wave 1 or extend up to 61.8% of Wave 1–3.

Using Fibonacci helps validate whether wave counts are realistic and supports projection of future targets.

🛠️ Tools to Assist Elliott Wave Analysis

You can use platforms like:

- TradingView: Custom wave drawing tools

- MetaTrader 4/5: Manual drawing with Fibonacci tools

- Elliott Wave-specific software: Like MotiveWave or Elliott Wave International tools

✅ Pros of Using Elliott Wave Theory in Forex

| Advantage | Explanation |

|---|---|

| 🔁 Predictive Power | Provides a framework to anticipate market moves |

| 🔬 Detailed Market Insight | Helps understand market structure and psychology |

| ⏳ Multi-time Frame Application | Works across short and long time frames |

| 🔗 Integrates Well | Can be combined with other indicators (Fibonacci, RSI, MACD) |

⚠️ Cons and Challenges

| Limitation | Explanation |

|---|---|

| ❓ Subjectivity | Wave counting is open to interpretation |

| 📉 Complex Patterns | Corrections like triangles and flats are hard to recognize |

| ⏰ Time Consuming | Requires constant monitoring and analysis |

| ❌ No Fixed Entry/Exit | Needs confirmation with other tools or price action |

📈 Real Example in Forex: EUR/USD Elliott Wave Setup

Let’s say the EUR/USD is in an uptrend:

- You identify a clear Wave 1, followed by a retracement for Wave 2.

- Wave 3 shows strong bullish momentum and breaks previous highs.

- Wave 4 consolidates near the 38.2% retracement of Wave 3.

- Wave 5 completes the impulse.

Now, using Fibonacci extension, you project an ABC correction with:

- Wave A down

- Wave B retracing 50% of A

- Wave C equal in length to Wave A

You set your next long position after the ABC correction ends.

🧠 Tips for Using Elliott Waves Effectively

- Start with higher time frames: This gives you the bigger picture.

- Always combine with other indicators: Use RSI, MACD, trendlines for confirmation.

- Keep wave counts flexible: The market evolves, and wave patterns can shift.

- Practice on historical charts: Develop an eye for structure before applying live.

🧾 Final Thoughts

Elliott Wave Theory is a powerful yet complex method of analyzing market trends and reversals. While it requires patience and practice, its structured approach provides a strategic edge—especially when combined with other tools and indicators.

In the ever-volatile Forex market, mastering wave analysis can help you predict price movements, time your entries and exits, and better manage risk.

If you’re looking for a strategy that goes beyond moving averages and simple indicators, Elliott Wave Theory could be the tool that elevates your trading to the next level.