Market Hours and Trading Sessions in Forex

Forex (foreign exchange) trading is the most active financial market in the world, with over $6 trillion traded daily. Unlike traditional stock markets that operate on set business hours, the Forex market is open 24 hours a day, five days a week. This continuous operation is made possible by the global nature of currency trading. But while the market is always “open,” not all hours are equally active. Understanding Forex market hours and trading sessions is crucial for optimizing trading strategies, managing risk, and capitalizing on the best opportunities.

In this guide, we’ll explore the global Forex trading hours, the four major trading sessions, session overlaps, and how traders can take advantage of this knowledge.

Why Forex Trades 24 Hours a Day

The Forex market operates 24 hours a day because currencies are always in demand. With different financial centers located across time zones—including New York, London, Tokyo, and Sydney—the market transitions from one trading center to the next, enabling uninterrupted trading from Monday to Friday.

However, this doesn’t mean that the entire market is equally active at all times. Market volatility and trading volume vary based on the session and the overlapping periods between sessions.

The Four Major Forex Trading Sessions

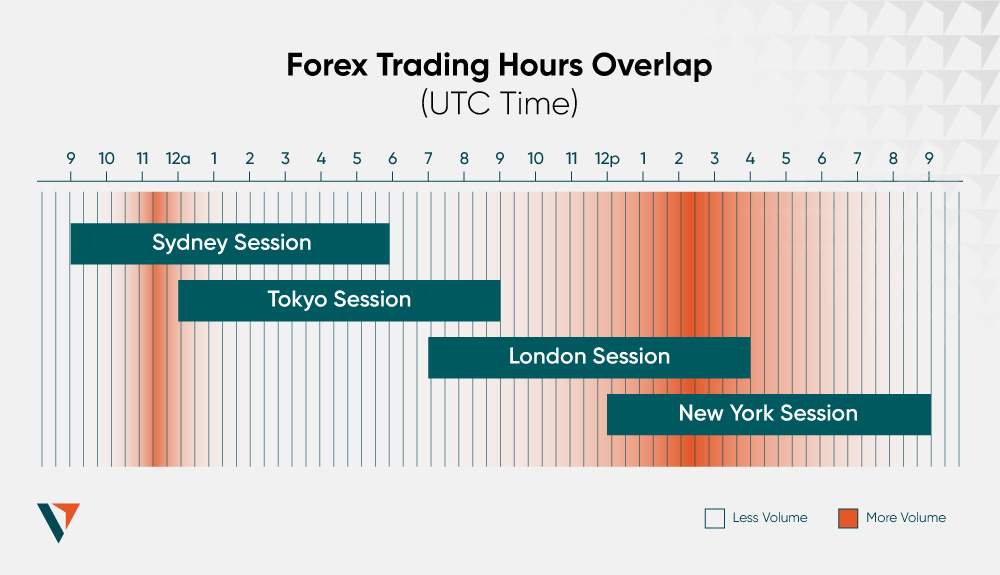

The Forex market is generally divided into four major trading sessions:

1. Sydney Session

- Time (UTC): 10:00 PM – 7:00 AM

- Time (EST): 5:00 PM – 2:00 AM

- Key Currency Pairs: AUD/USD, NZD/USD

The Sydney session kicks off the Forex trading day. Although it is generally the least volatile session, it can be significant for trading the Australian Dollar (AUD) and New Zealand Dollar (NZD), especially when news or economic data is released in the region.

2. Tokyo (Asian) Session

- Time (UTC): 12:00 AM – 9:00 AM

- Time (EST): 7:00 PM – 4:00 AM

- Key Currency Pairs: USD/JPY, EUR/JPY, AUD/JPY

The Tokyo session overlaps with the Sydney session for a few hours, leading to increased liquidity. This session is crucial for trading yen-related pairs and is known for its steady price movements.

3. London Session

- Time (UTC): 8:00 AM – 5:00 PM

- Time (EST): 3:00 AM – 12:00 PM

- Key Currency Pairs: EUR/USD, GBP/USD, USD/CHF

The London session is one of the most active sessions due to the involvement of European markets and large volumes of institutional trading. The volatility and volume during this session offer some of the best trading opportunities, especially for major currency pairs.

4. New York Session

- Time (UTC): 1:00 PM – 10:00 PM

- Time (EST): 8:00 AM – 5:00 PM

- Key Currency Pairs: EUR/USD, GBP/USD, USD/JPY, USD/CAD

The New York session overlaps with the London session for a few hours and is the second most active session. Market movement is often driven by U.S. economic data releases and activity on Wall Street.

Session Overlaps: When the Market is Most Active

The most favorable trading opportunities often occur during the overlap periods, when two major sessions are open simultaneously:

London/New York Overlap (8:00 AM – 12:00 PM EST)

- This is the most volatile period of the trading day.

- High trading volume and sharp price movements are common.

- EUR/USD, GBP/USD, and USD/CHF are especially active.

Tokyo/London Overlap (3:00 AM – 4:00 AM EST)

- A shorter and less volatile overlap.

- May still offer opportunities for yen-based pairs.

Sydney/Tokyo Overlap (7:00 PM – 2:00 AM EST)

- Good for trading AUD/JPY and other Asia-Pacific currencies.

Market Hours by Region

To understand market hours in your own time zone, here is a simplified global breakdown:

| Region | Session | EST Hours | Activity Level |

|---|---|---|---|

| Australia | Sydney | 5 PM – 2 AM | Low |

| Asia | Tokyo | 7 PM – 4 AM | Medium |

| Europe | London | 3 AM – 12 PM | High |

| North America | New York | 8 AM – 5 PM | High |

Use Forex market clocks or converters to plan trades in your local time.

How Trading Sessions Affect Currency Pairs

Certain currencies perform better during specific sessions due to regional economic activity:

- USD/JPY: Active during Tokyo and New York

- GBP/USD and EUR/USD: Most active during London and New York sessions

- AUD/USD: Active during Sydney and Tokyo sessions

Being aware of when your target currency pair is most active helps in setting better stop-loss and take-profit levels.

Best Times to Trade Forex

The best times to trade are generally during high-volatility sessions, especially:

- London/New York Overlap (8 AM – 12 PM EST)

- London Session Opening (3 AM – 5 AM EST)

- Early New York Session (8 AM – 10 AM EST)

However, experienced traders may also find opportunities during less active sessions by using strategies like range trading.

Times to Avoid Trading

- Late Fridays: Reduced liquidity as traders close positions for the weekend.

- Sundays/Mondays: Market is slower as it gradually opens.

- Major holidays: Thin liquidity can result in unpredictable moves.

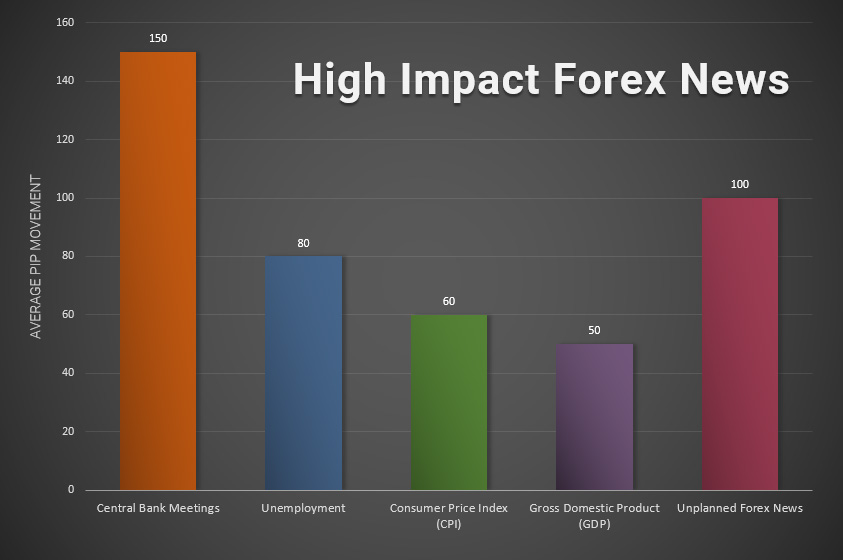

Impact of News on Trading Sessions

Major economic releases and geopolitical news can shake up the market regardless of the session. Always pay attention to:

- U.S. Non-Farm Payrolls (NFP)

- Federal Reserve interest rate decisions

- European Central Bank (ECB) announcements

- Inflation and unemployment data

These events often occur during the New York or London sessions and can increase volatility significantly.

Tips for Trading Based on Sessions

- Match Strategy with Session: Use breakout strategies during volatile sessions and range trading during quieter ones.

- Adjust Risk: Use tighter stops in volatile sessions and wider stops during low liquidity.

- Use a Session Indicator: Many trading platforms offer indicators that highlight current sessions.

Conclusion

Understanding Forex market hours and trading sessions is essential for anyone looking to trade effectively. By knowing when the market is most active and how session overlaps affect volatility, traders can strategically plan their entries and exits, optimize their trading hours, and avoid unnecessary risk.

Whether you’re a day trader seeking quick profits or a swing trader looking for broader moves, timing your trades around the most favorable sessions can give you a strong edge in the dynamic Forex market.