The Impact of News on Forex Markets

The Forex market is one of the most dynamic and volatile financial markets globally. One of the primary drivers behind its price fluctuations is the news. Whether it is economic data, political events, or unexpected developments, news can significantly influence the movement of currency prices. In this article, we will delve deep into how news impacts the Forex market, the different types of news, and how traders can effectively use this information in their trading strategies.

The Role of News in Forex Markets

Forex prices are driven by supply and demand, and news plays a pivotal role in influencing these factors. When a piece of news is released, traders and investors respond by buying or selling currencies, which leads to price movements. News impacts the market because it can affect perceptions about a country’s economic strength, political stability, or future outlook. These perceptions can change how traders position themselves, influencing short-term and long-term trends.

Types of News That Impact Forex

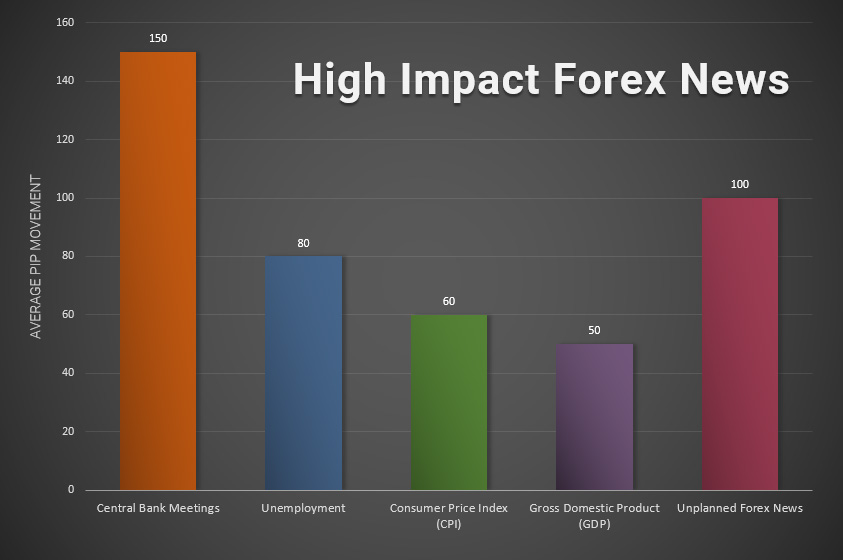

Several types of news have a direct impact on currency prices. Below are the most prominent ones:

1. Economic Data Releases

Economic data is among the most influential types of news in the Forex market. These reports give insight into the health of a country’s economy and provide clues about future monetary policy decisions. Key economic reports include:

- Gross Domestic Product (GDP): GDP is a critical indicator of a country’s overall economic activity and growth. A rising GDP suggests a growing economy, which tends to strengthen the country’s currency. Conversely, a declining GDP can weaken the currency.

- Interest Rates: Central banks, such as the Federal Reserve in the United States or the European Central Bank (ECB), set interest rates, which significantly impact currency value. Higher interest rates often lead to stronger currencies because they attract foreign capital seeking higher returns.

- Inflation Reports (CPI): Inflation directly affects purchasing power. A higher Consumer Price Index (CPI) usually signals an overheating economy, which might prompt central banks to raise interest rates. This can cause the currency to appreciate.

- Employment Data (NFP): Employment figures, especially the Non-Farm Payroll (NFP) report in the U.S., provide a snapshot of a country’s labor market. Strong employment numbers suggest economic strength, which can lead to a stronger currency.

- Retail Sales: Retail sales data measures consumer spending, which drives economic growth. Higher retail sales often lead to a stronger currency as they signal healthy demand in the economy.

2. Political Events

Political stability and decisions play a huge role in Forex price movements. When a country faces political uncertainty or a change in government, its currency can experience significant fluctuations. Examples of political events include:

- Elections: Political elections can lead to uncertainty regarding economic policies, particularly if the results are unexpected or controversial. Uncertainty can cause fluctuations in currency values as traders try to predict the impact of a new administration.

- Geopolitical Tensions: Conflicts, wars, or tensions between countries can lead to a flight to safety, where traders move their investments into stable currencies like the U.S. dollar or the Swiss franc, causing volatility in other currencies.

- Government Policy Announcements: Announcements regarding fiscal policy, trade agreements, or sanctions can have an immediate impact on currency values. For example, the imposition of tariffs or new trade deals can impact the value of a currency.

3. Central Bank Decisions

Central banks are perhaps the most important actors in the Forex market. They influence currencies through their monetary policies, which include setting interest rates, quantitative easing, and interventions in the currency market. When central banks make announcements about changes in monetary policy, it can create immediate and significant market reactions.

- Interest Rate Decisions: As mentioned earlier, interest rates are one of the most important factors affecting a currency’s value. A decision by a central bank to raise or cut interest rates can cause the currency to appreciate or depreciate, depending on the direction of the change.

- Quantitative Easing (QE): When central banks implement QE, they inject money into the economy by purchasing financial assets. This increases the money supply and can lead to a depreciation of the currency. Traders closely monitor announcements about QE programs.

- Intervention in Currency Markets: Occasionally, central banks may directly intervene in the Forex market to stabilize their currency. For example, a central bank might sell its currency to weaken it if the value is perceived as too high, affecting exports and economic growth.

4. Natural Disasters and Other Unexpected Events

While less predictable, natural disasters, pandemics, or other unforeseen events can significantly impact currency prices. These events can disrupt economic activity and cause shifts in market sentiment. For example:

- Natural Disasters: Earthquakes, tsunamis, or floods can damage infrastructure and reduce economic output, which may weaken the currency.

- Pandemics: The COVID-19 pandemic caused massive volatility in the Forex market as governments introduced lockdowns, fiscal measures, and stimulus programs. The pandemic disrupted global trade, leading to a flight to safety and the appreciation of certain currencies like the U.S. dollar.

- Terrorist Attacks or Global Crises: Events like the September 11 attacks or financial crises can cause sharp reactions in the Forex market. During times of crisis, traders often seek the safety of stable currencies, leading to volatility in other markets.

How Traders Can Use News in Forex Trading

For Forex traders, staying informed about economic and political developments is critical to making profitable decisions. Here are some ways traders can effectively use news in their trading strategies:

1. Follow Economic Calendars

Traders use economic calendars to keep track of upcoming events and data releases. By staying ahead of significant economic announcements, traders can anticipate market reactions and plan their trades accordingly. For example, if an interest rate hike by the U.S. Federal Reserve is expected, traders may position themselves to take advantage of the potential strengthening of the U.S. dollar.

2. News Trading Strategies

Some traders specialize in “news trading,” which involves making quick trades in response to news events. These traders often operate on very short timeframes, using tools like economic calendars to prepare for the release of key data. They also rely on technical analysis to pinpoint entry and exit points.

- Breakout Trading: News can cause sudden price movements, leading to breakouts. Traders often use this volatility to enter positions when the price moves beyond key support or resistance levels.

- Fade the News: In some cases, traders may choose to fade the initial reaction to news. This involves betting against the market’s initial knee-jerk response, based on the assumption that the market will correct itself in the opposite direction.

3. Understand Market Sentiment

Market sentiment refers to the general mood or attitude of traders toward a particular currency or asset. By reading news reports and analyzing the market’s reaction to certain events, traders can gauge sentiment and use it to predict future price movements. For example, if a country’s GDP report is better than expected, traders may interpret it as a signal of economic strength, leading them to buy that currency.

Conclusion

News is a powerful driver of currency price movements in the Forex market. From economic data releases and political events to central bank decisions and unexpected crises, news can lead to significant volatility and price fluctuations. Successful Forex traders understand how to use news to their advantage by staying informed, following economic calendars, and developing news trading strategies.

By understanding the relationship between news and currency price movements, traders can position themselves to take advantage of market opportunities while managing the risks associated with news-driven volatility. Whether you’re an experienced trader or a newcomer, incorporating news analysis into your trading strategy is essential for success in the Forex market.