The psychology of winning and losing in Forex

The psychology of winning and losing in Forex trading plays a crucial role in determining the long-term success of a trader. Trading isn’t just about understanding charts, analyzing trends, and mastering technical indicators. It is also about how traders handle emotions, develop their mindset, and respond to both wins and losses. Emotions like fear, greed, and impatience can cloud judgment and result in costly mistakes. In contrast, a disciplined, well-regulated mindset can lead to consistent profits.

In this detailed article, we will explore the psychology behind winning and losing in Forex trading, what drives emotional reactions, and how to develop the mental resilience needed to be a successful trader.

1. Understanding the Emotional Roller Coaster of Forex Trading

Forex trading, unlike traditional investments, can evoke strong emotional responses because of its high volatility, the ability to trade on margin, and the constant fluctuations in the market. These emotions often fall into two categories:

A. Emotions Associated with Winning

- Euphoria: A trader may feel on top of the world after a series of successful trades. They may feel overconfident or even invincible, which can lead to reckless trading decisions. The success of a single trade or series of trades may create an inflated sense of self-assurance.

- Greed: After a winning streak, traders may want more, increasing their risk appetite. This can lead to taking overly aggressive positions, hoping for even higher returns without considering the risk involved.

- Overconfidence: Winning trades can foster overconfidence, where a trader believes they can predict market movements with accuracy. This leads to neglecting risk management, potentially resulting in large losses.

B. Emotions Associated with Losing

- Fear: Losses are a part of the game, but they can trigger fear in traders, making them hesitant to enter the market again. Fear can lead to missed opportunities or overly conservative decisions that prevent traders from maximizing potential profits.

- Frustration: When a trader experiences a series of losses, they may become frustrated. This frustration can cloud judgment, leading to revenge trading, where the trader tries to recover losses by taking impulsive, high-risk trades.

- Denial: After losing a trade, some traders refuse to acknowledge their mistakes. Instead of reviewing their strategy or performance, they continue with the same approach, hoping for a different outcome.

2. The Impact of Emotional Trading on Decisions

A. Fear of Missing Out (FOMO)

FOMO is a common psychological trap in Forex trading. When a trader sees the market moving in one direction and feels left out, they might jump into a trade without a solid strategy. This impulse is fueled by the emotional need to capitalize on every opportunity, which often leads to poor entry points and subsequent losses.

- Solution: Discipline and patience are essential. Traders should stick to their trading plans, use proper risk management, and not chase the market.

B. Revenge Trading

Revenge trading is the practice of trying to recover losses by entering high-risk positions after a loss. This emotional reaction often exacerbates losses because traders tend to increase their position sizes or deviate from their trading strategies.

- Solution: Take a step back and cool off. After a loss, it is essential to evaluate what went wrong, learn from the mistake, and avoid impulsively entering the next trade.

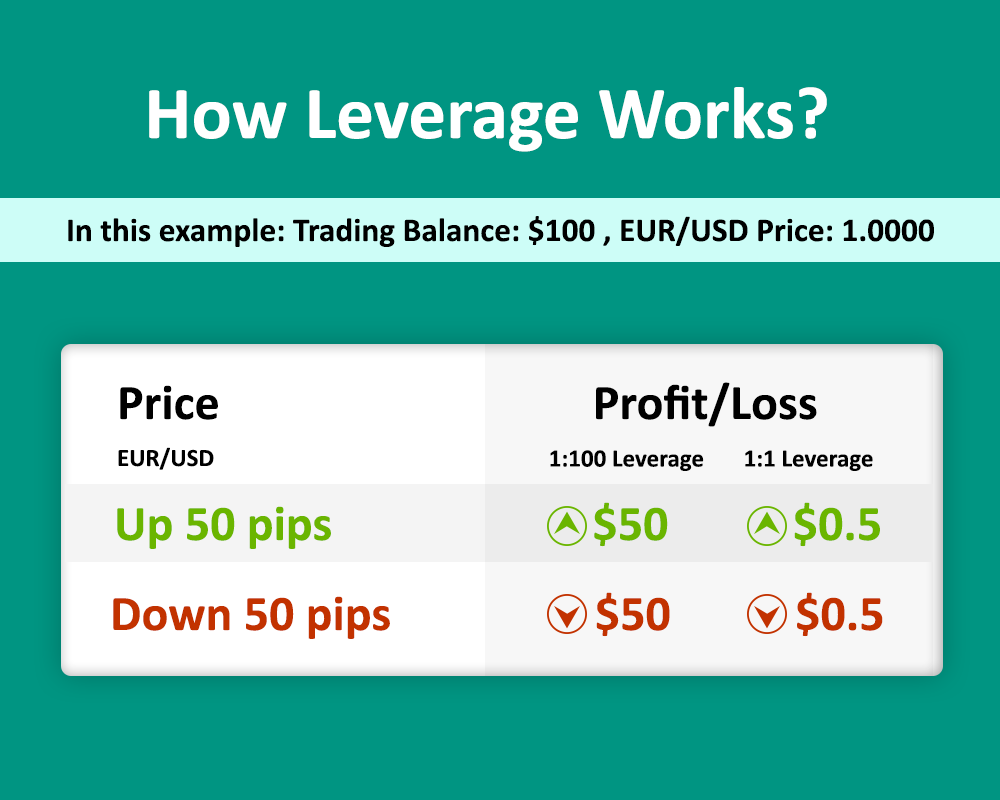

C. Overleveraging

Overleveraging is another psychological mistake where traders use more leverage than they can afford, driven by the desire to magnify profits. This can lead to significant losses when the market moves against the trader.

- Solution: Stick to conservative leverage ratios and focus on risk management. It’s better to trade small and steady, maintaining consistency rather than betting large sums on single trades.

3. Developing a Winning Trader’s Psychology

A. Understanding Market Risk

A successful Forex trader understands that the market is inherently unpredictable, and they must acknowledge the possibility of loss in every trade. Instead of avoiding losses, they embrace risk management strategies that help limit losses to acceptable levels.

B. Creating a Trading Plan

Having a well-defined trading plan helps in maintaining emotional control. A trading plan includes:

- Clear entry and exit rules

- Risk-reward ratios

- Stop-loss and take-profit levels

- Position sizing rules

- Trading times and schedules

By following a structured plan, traders are less likely to be swayed by emotions like fear or greed and more likely to stick to their strategy.

C. Mindfulness and Emotional Awareness

Mindfulness helps traders understand their emotions, allowing them to respond rationally to market movements. Traders can improve emotional resilience through practices such as meditation, journaling, or self-reflection after each trade. Understanding one’s emotional state will help them act based on logic rather than impulsivity.

D. Accepting Losses as Part of the Process

One of the key characteristics of a successful trader is their ability to accept losses gracefully. Every trader faces losses, and they are a natural part of the trading journey. Instead of focusing on the loss itself, successful traders look for the lessons learned. This mindset allows them to continually improve and adapt their strategies.

- Solution: Keep losses small, and focus on long-term profitability rather than short-term fluctuations.

4. The Role of Discipline in Forex Trading

Discipline is the cornerstone of consistent success in Forex. The ability to follow a structured trading plan without deviating from it during moments of excitement, fear, or frustration is what differentiates professional traders from amateurs.

A. Sticking to the Plan

Discipline requires that traders stick to their trading plan, even when they are experiencing a win or loss streak. This includes adhering to risk management techniques like setting stop-loss levels and sticking to them.

B. Limiting Trading Sessions

Limiting the amount of time spent trading can help maintain focus. Prolonged trading hours often lead to fatigue, which can cloud judgment. Traders who limit their time in the market are less likely to make impulsive decisions.

5. Psychological Strategies to Overcome Common Trading Mistakes

A. Use of Trade Journals

A trade journal helps traders track their emotional states during each trade. By noting their feelings—whether excitement, anxiety, or confidence—they can later analyze patterns in their decision-making. Understanding these patterns allows them to manage their emotional responses better in future trades.

B. Breaks Between Trades

Taking regular breaks between trades can prevent the mind from becoming overwhelmed by emotions. These breaks allow traders to reset mentally and return to trading with a clear mind.

C. Keeping a Balanced Life

Forex trading should not dominate a trader’s life. Having a balanced lifestyle with physical exercise, social activities, and relaxation helps keep stress levels in check and promotes mental clarity.

6. Conclusion: The Key to Longevity in Forex Trading

The psychology of winning and losing in Forex trading is crucial for success. Emotions like fear, greed, and overconfidence can derail a trader’s progress if not managed effectively. To become a successful trader, it is essential to develop a disciplined mindset, embrace loss as a learning opportunity, and maintain emotional control in every trade.

Traders must develop the ability to manage their emotions and cultivate the right psychological traits. By adhering to a solid trading plan, implementing risk management techniques, and acknowledging emotional responses, traders can increase their chances of long-term success in the volatile world of Forex trading.