Understanding Forex Brokers and Their Roles

In the world of Forex trading, brokers are pivotal to facilitating trades between retail traders and the foreign exchange market. Whether you’re a novice entering the world of currency trading or an experienced trader, understanding the role of Forex brokers is essential. A Forex broker acts as an intermediary between you and the global Forex market, providing the platform and tools needed to execute your trades. In this detailed guide, we will break down what Forex brokers are, the different types, how they work, and why they are so integral to your trading success.

What is a Forex Broker?

A Forex broker is a financial services company that provides traders with access to platforms through which they can buy and sell currencies in the foreign exchange market. Forex brokers are the go-between for traders and the larger Forex market, facilitating orders between buyers and sellers. They play a significant role in providing liquidity, executing trades, and ensuring that currency transactions occur efficiently.

Forex brokers also provide access to leverage, allowing traders to control larger positions than they could with their capital alone. In addition, they often offer various tools, such as charting software, economic calendars, and risk management tools, to assist traders in making informed decisions.

Types of Forex Brokers

There are several different types of Forex brokers, each offering various services to their clients. These brokers can be categorized based on their trading execution methods, commission structures, and business models. Below are the most common types:

1. Dealing Desk (DD) Brokers

Dealing Desk brokers, also known as market makers, are the intermediaries between the trader and the market. They create a market for their clients by acting as the counterparty to their trades. This means that when a trader places an order, the Dealing Desk broker will either fill that order with their own liquidity or offset the position with another client’s order.

Features of Dealing Desk Brokers:

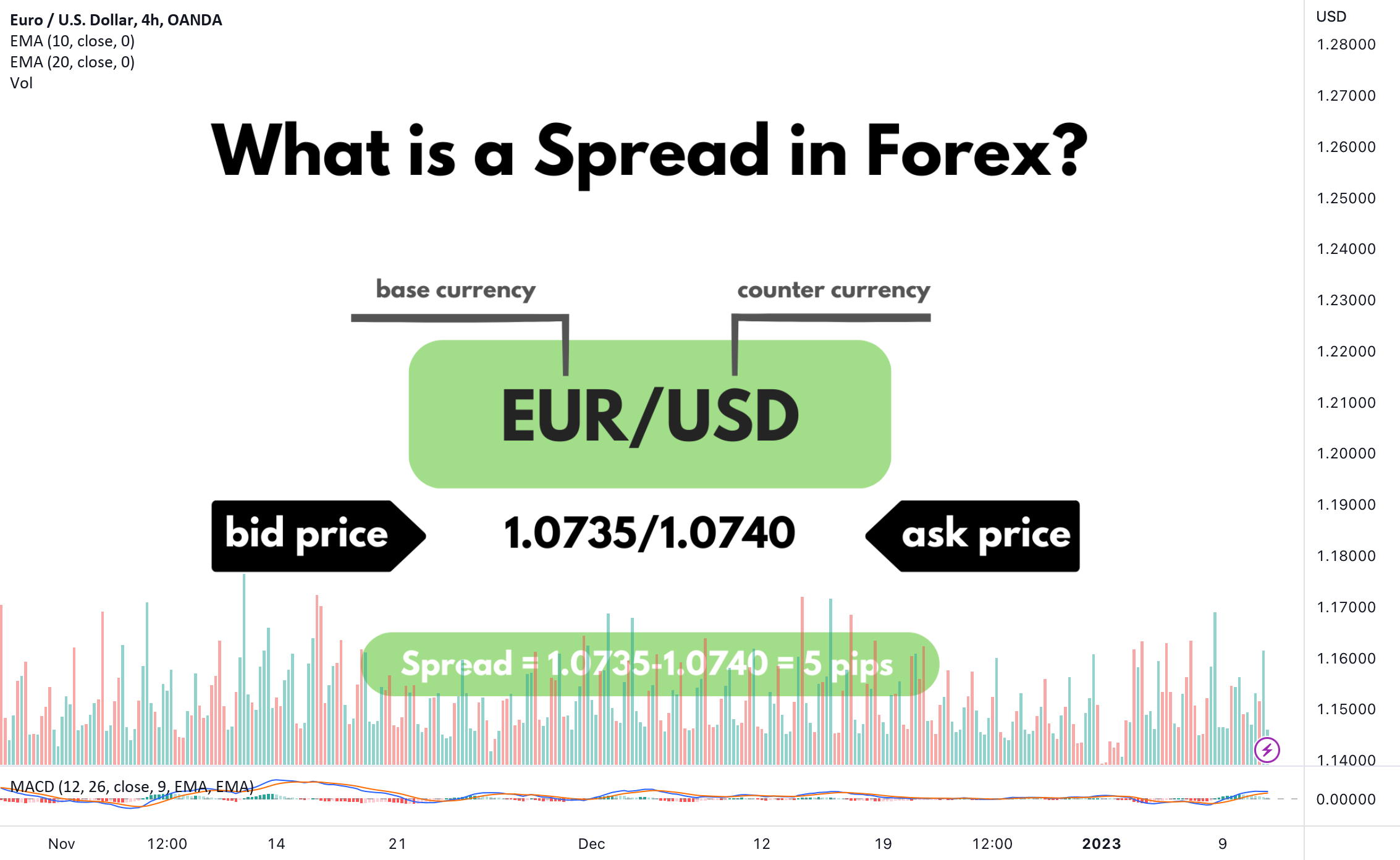

- Spread-based fees: The broker typically earns money through the spread, which is the difference between the bid and ask prices.

- Fixed spreads: The broker may offer fixed spreads, meaning the difference between buy and sell prices remains constant regardless of market conditions.

- Lower entry barriers: Dealing Desk brokers often provide access to smaller account sizes, making it easier for beginner traders to get started.

Pros:

- Fixed spreads provide predictability in costs.

- Customer support is often more personalized as brokers control the execution.

Cons:

- Potential conflict of interest, as the broker profits when traders lose.

- Lower liquidity compared to non-dealing desk brokers.

2. No Dealing Desk (NDD) Brokers

No Dealing Desk brokers provide direct market access to traders. They do not take the other side of a client’s trade; instead, they pass the trade directly to the interbank market or liquidity providers, allowing traders to interact directly with other market participants.

Features of NDD Brokers:

- Variable spreads: The spread may widen or narrow depending on the market conditions.

- STP and ECN models: NDD brokers use Straight Through Processing (STP) or Electronic Communication Network (ECN) to execute orders.

Pros:

- Better liquidity, as orders are filled directly from the interbank market.

- More transparent pricing: Prices tend to be closer to the actual market price.

- No conflict of interest: The broker does not benefit from clients losing.

Cons:

- Variable spreads can result in higher costs during volatile periods.

- Higher minimum deposit requirements for access to ECN accounts.

3. ECN Brokers

ECN (Electronic Communication Network) brokers connect traders directly to other market participants, including banks, financial institutions, hedge funds, and other traders. ECN brokers offer transparent pricing with no middleman involved, which results in more competitive spreads.

Features of ECN Brokers:

- Market depth: ECN brokers provide full transparency of market depth, showing the liquidity available at each price level.

- Commission-based fees: ECN brokers typically charge a commission per trade instead of earning from the spread.

Pros:

- Tight spreads during normal market conditions.

- Low latency execution: Orders are executed quickly, with minimal slippage.

- Access to institutional-level liquidity.

Cons:

- Commission fees: Traders must pay a commission per trade, which can add up over time.

- Higher minimum deposit requirements compared to market makers.

How Forex Brokers Make Money

Forex brokers make money through various mechanisms depending on their business model. The most common ways brokers earn revenue are:

- Spreads: The difference between the buying and selling prices is called the spread. Brokers often earn money from the spread, especially market makers.

- Commissions: ECN and STP brokers charge a commission on each trade, typically a fixed fee per volume.

- Swaps/Overnight Financing: Forex brokers can also earn money from swaps, the interest rate differential between the two currencies in a currency pair.

- Markups on Spreads: In the case of Dealing Desk brokers, they may add a markup to the spread to increase their profit margin.

Regulation of Forex Brokers

Forex brokers operate in a highly regulated environment, especially in major markets like the United States, the European Union, and Australia. Regulatory bodies ensure that brokers follow certain standards to protect traders from fraud and malpractice. Some of the most reputable regulatory bodies in the Forex industry include:

- The Commodity Futures Trading Commission (CFTC) and National Futures Association (NFA) in the US.

- The Financial Conduct Authority (FCA) in the UK.

- Australian Securities and Investments Commission (ASIC) in Australia.

- The Cyprus Securities and Exchange Commission (CySEC) in Europe.

Regulation ensures that brokers offer a fair and transparent environment for trading and that they adhere to high standards of financial integrity.

Choosing the Right Forex Broker

When selecting a Forex broker, traders should consider the following factors:

1. Regulation and Safety

Choose a broker that is regulated by a reputable authority. This helps ensure that the broker adheres to financial standards and offers a safe trading environment.

2. Trading Platform

The trading platform is the primary interface between traders and the Forex market. Ensure that the broker offers a reliable, user-friendly platform with advanced charting tools, fast order execution, and good customer support.

3. Fees and Commissions

Consider the cost of trading, including spreads, commissions, and swaps. A broker with lower fees can provide more cost-effective trading, especially for high-frequency traders.

4. Customer Support

Good customer support is essential, especially for beginners who may have questions about the platform or trading in general. Look for brokers that offer responsive support, available 24/7.

5. Account Types

Some brokers offer various types of accounts to suit different trading strategies and capital levels. Look for brokers that offer demo accounts, low minimum deposit requirements, and flexible account options.

6. Leverage and Margin

Leverage is the ability to control a large position with a smaller amount of capital. Consider the amount of leverage the broker offers and ensure it aligns with your risk tolerance.

Conclusion

Forex brokers are integral to the world of Forex trading, providing traders with access to the market and essential trading tools. Understanding the different types of brokers, their fee structures, and how they make money is crucial for selecting the right broker for your trading style. Whether you choose a market maker, an ECN broker, or an STP broker, ensure that the broker is regulated, offers competitive fees, and provides a reliable platform. By doing so, you can maximize your trading potential and increase your chances of success in the global Forex market.