What is a Pip in Forex? Complete Guide for Beginners

In the fast-paced world of foreign exchange (Forex) trading, you’ll often hear the term “pip” being used. Whether you’re a beginner or brushing up your knowledge, understanding what a pip is and how it affects your trading is essential to success in the Forex market. So, what is a pip in Forex, and why is it so important? Let’s dive deep into this fundamental concept.

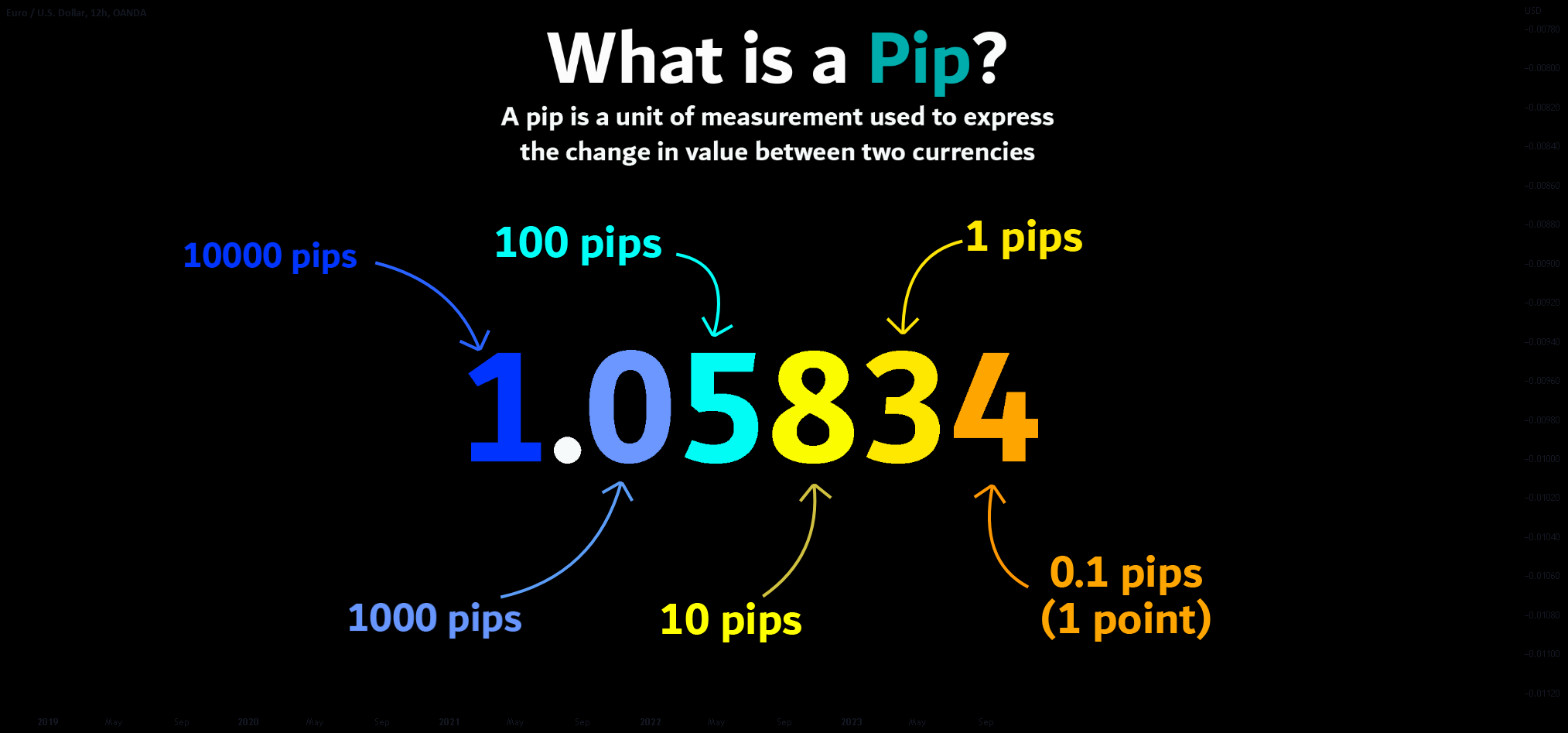

What is a Pip?

Pip stands for “Percentage in Point” or “Price Interest Point.” It is the smallest standardized price movement in the Forex market. In most currency pairs, a pip equals 0.0001 (fourth decimal place). However, for pairs that include the Japanese Yen (JPY), a pip equals 0.01 (second decimal place).

📌 Example:

- For EUR/USD, if the price moves from 1.1050 to 1.1051, that’s a 1 pip movement.

- For USD/JPY, if the price moves from 109.45 to 109.46, that’s also 1 pip.

Pips help traders measure price movements, calculate profits/losses, and manage risk. It’s a standard unit that levels the playing field, allowing consistent communication across platforms and brokers.

Why Pips Matter in Forex Trading

In Forex, currencies are traded in lots, and small price changes can lead to significant profits or losses when large amounts are traded. Pips provide a precise way to quantify these changes.

✅ Uses of Pips:

- Determine price movement

- Calculate trade profits/losses

- Measure volatility

- Set stop-loss and take-profit orders

- Assess risk-to-reward ratio

How to Calculate the Value of a Pip

The pip value depends on the:

- Currency pair being traded

- Trade size (lot size)

- Exchange rate

- Account currency

🔢 Standard Pip Value Formula:

Pip Value = (One Pip / Exchange Rate) × Lot Size

Let’s break it down based on different lot sizes:

| Lot Size | Units | Pip Value (in USD) |

|---|---|---|

| Standard Lot | 100,000 | $10 |

| Mini Lot | 10,000 | $1 |

| Micro Lot | 1,000 | $0.10 |

Pipette – Going Even Smaller

Some brokers use fractional pips called pipettes. A pipette is 1/10th of a pip.

- In a 5-decimal quote: 1 pip = 0.00010; 1 pipette = 0.00001

- In a 3-decimal JPY quote: 1 pip = 0.010; 1 pipette = 0.001

This allows for more precise pricing and tighter spreads.

Examples of Pip Calculations

Example 1: EUR/USD Trade

- You buy 1 standard lot (100,000 units) at 1.1200

- Price rises to 1.1210

- Movement = 10 pips

- Pip value = $10 (standard lot)

- Profit = 10 pips × $10 = $100

Example 2: USD/JPY Trade

- You sell 1 mini lot (10,000 units) at 110.50

- Price drops to 110.30

- Movement = 20 pips

- Pip value = ~$0.91 (depends on exchange rate)

- Profit ≈ 20 pips × $0.91 = $18.20

How Pips Affect Your Trading

1. Risk Management

Traders use pips to set stop-loss and take-profit levels, which control how much they risk on each trade.

2. Position Sizing

Using pip values, traders can calculate how large a position they should take based on their risk tolerance.

3. Strategy Building

Backtesting a trading strategy often involves analyzing pip movement to determine profitability over time.

Pips vs. Points vs. Ticks

| Term | Used In | Represents |

|---|---|---|

| Pip | Forex | Smallest price move in currency pairs |

| Point | Stocks/Futures | A whole number price move (e.g., $1) |

| Tick | Futures/Options | Minimum price fluctuation in the market |

So, while they’re similar in concept, they are not interchangeable.

Common Mistakes Beginners Make with Pips

❌ Confusing pips and lot sizes:

Some new traders think all pips are worth the same. But pip value depends on lot size.

❌ Ignoring pip value when setting stop-loss:

Risking too many pips on a small account can lead to large losses.

❌ Not calculating profits/losses accurately:

Many traders fail to account for pip value based on currency and trade size.

Tools to Help with Pip Calculations

You don’t need to manually calculate pip values every time. Many trading platforms and brokers offer:

- Pip calculators

- Profit/Loss calculators

- Integrated trading platforms (like MetaTrader) that show pip value per trade

Conclusion: Mastering the Pip

Understanding pips is a foundational skill in Forex trading. Pips allow traders to speak a common language, measure movement, and manage risk effectively. Whether you’re placing your first trade or developing a complex trading system, knowing how to calculate and use pips will make you a more confident and capable trader.

So the next time someone asks, “How many pips did you make today?”, you’ll not only know how to answer—you’ll know exactly what it means for your bottom line.