🇺🇸 U.S. Economic Developments 2025: Tariffs, Market Reactions & Global Impact

Keywords: U.S. economy 2025, Trump tariffs, global market reaction, economic news April 2025, trade war, stock market, US inflation, Fed interest rates

🔍 Introduction

The year 2025 has brought bold economic changes in the United States, with newly announced tariffs shaking both local industries and global markets. As the U.S. continues to assert a protectionist stance, global investors, businesses, and consumers alike are closely watching the ripple effects. Here’s everything you need to know about the latest U.S. economic developments.

📜 Trump’s New Tariff Policy

In a sweeping move, President Donald Trump has imposed:

- 10% base tariffs on all U.S. imports

- Targeted higher tariffs, including:

- 34% on Chinese imports

- 46% on Vietnamese imports

- 24% on Japanese imports

- 20% on goods from the European Union

These tariffs are the highest trade barriers enacted by the U.S. in over a century. The goal? To protect domestic manufacturing, reduce trade deficits, and assert control over foreign competition.

📉 Global Market Reactions

📈 Stock Market Volatility

- Japan’s Nikkei: Down 6.6%

- South Korea’s KOSPI: Down 5%

- China’s CSI 300: Down 6.3%

- U.S. Nasdaq futures: Fell by 4.4%

Investors are bracing for a slowdown in global trade, which could push the world closer to a recession.

💱 Currency Market Impact

- Safe haven currencies like the Japanese Yen and Swiss Franc have risen.

- Riskier currencies, including the Australian and New Zealand Dollars, have dropped in value.

🏦 Interest Rate Speculation

As fears of economic slowdown intensify, speculation is growing that the U.S. Federal Reserve will begin cutting interest rates, possibly as early as May 2025, in an effort to stimulate the economy.

🏭 Sector-Specific Impact

🔌 Technology

Companies reliant on international components, especially from Asia, may experience supply chain disruptions and higher production costs.

⚙️ Manufacturing & Trade

While some U.S. manufacturers may benefit from less competition, increased costs on imported materials could reduce margins.

🛢️ Energy & Chemicals

The energy sector is particularly vulnerable. The tariffs could disrupt trade in liquefied petroleum gas (LPG) and ethane, previously strong exports to China.

💬 Expert Opinions

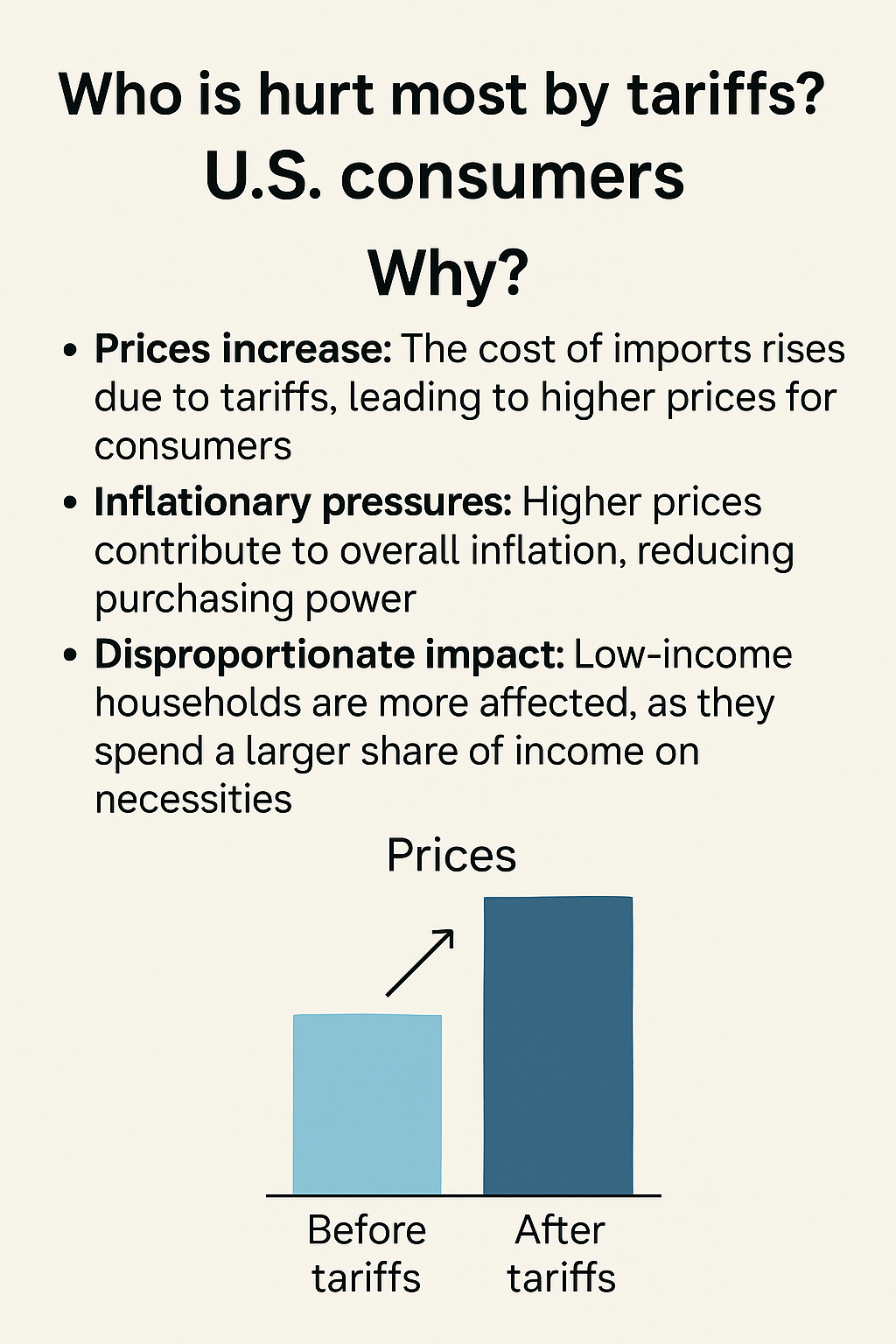

Economists warn that such sweeping tariffs could:

- Lead to higher consumer prices

- Hurt small and mid-sized businesses

- Trigger retaliatory tariffs from affected nations

- Increase inflation while lowering global demand

✅ What This Means for You

Whether you’re an investor, entrepreneur, or consumer, here’s how to stay informed and proactive:

- Monitor Fed announcements regarding interest rate changes

- Diversify your investments to hedge against global volatility

- Review your supply chain if you’re in manufacturing or retail

- Stay informed through reliable sources like Reuters and Bloomberg

🧠 Final Thoughts

The U.S. economy in 2025 is undergoing a pivotal transformation. With new tariffs and market shifts, staying ahead of the curve is more important than ever. Whether these measures boost long-term domestic growth or trigger broader global tensions remains to be seen — but the impact is already being felt across industries.

📌 For more details and real-time updates, visit Reuters Economic News

![Breaking U.S. News: Major Protests, Extreme Weather, and Public Health Concerns [April 2025 Update] 4 Breaking U.S. News](https://wikithink.today/wp-content/uploads/2025/04/Breaking-U.S.-News.jpeg)